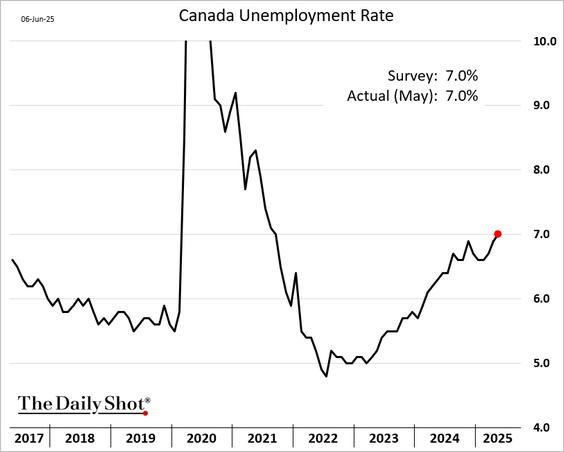

Canada’s unemployment rate has climbed to 7% from 6.2% a year ago, and up 210 basis points from 4.9% in June 2022 (chart below via The DailyShot). Excluding the pandemic, this is the highest unemployment rate since 2016 (Statscan report here). A 180-basis-point increase in the jobless rate over two years has historically been a reliable indicator of a recession.

The broadest form of unemployment, the R-8 measure that includes all forms of idle labour (officially unemployed as well as discouraged workers who have stopped looking, the waiting group expecting to start a job soon, and those involuntarily part-time) has risen to 9.2% from 8.4% a year ago and 7.2% two years ago. The unemployment rate for workers aged 15 to 22 in Canada was 20.1 % as of May, up from a June 2022 low of 9.2 %.

The broadest form of unemployment, the R-8 measure that includes all forms of idle labour (officially unemployed as well as discouraged workers who have stopped looking, the waiting group expecting to start a job soon, and those involuntarily part-time) has risen to 9.2% from 8.4% a year ago and 7.2% two years ago. The unemployment rate for workers aged 15 to 22 in Canada was 20.1 % as of May, up from a June 2022 low of 9.2 %.

The Bank of Canada and other key economic forecasters anticipate that unemployment will continue to rise into 2026.

Lest we underestimate the degree of rate shock unfolding here, the Bank of Canada (following the US Fed’s lead) held its policy rate at an unprecedented/reckless 0.25% from early 2009 through 2010 and sub-1% through mid-2017. After finally increasing to 1.75% by early 2019, it was slashed back to 0.25% in early March 2020 and remained there through April 2022, before tightening to 5% by July 2023.

In addition to unprecedented monetary stimulus from 2009 through 2023, Canadians received record government subsidies in the form of handouts and deferred debt payments—the private sector borrowed to the hilt, driving self-destructive household consumption and a world-famous real estate bubble.

Now, not surprisingly, tariffs, inflated prices, higher interest rates and deflating property values are all weighing on the Canadian economy. Domestic consumption was practically absent in the first quarter, and the advance estimate of April GDP was not encouraging.

Has the Bank of Canada learned a lesson from the train wreck of near-zero rate policies? Or are we headed back near the zero-bound as the housing-sensitive economy continues to tumble? I fear the latter–especially once the stock market begins to plunge and casualties are screaming for rescue. Still, as with tightening cycles, easing efforts are no quick fix.

We have not seen a credit and real estate contraction like this one since 2006-10, the early 1990s and the early 1980s. Most people have no clue how deep and prolonged such downturns tend to be, but we’re about to have a crash course. The segment below is worthwhile.

David Rosenberg, Founder & President, Rosenberg Research, talks about the Bank of Canada’s decision to hold interest rates and says there is a good chance the economy is slipping into recession. Here is a direct video link.