The mainstream was “shocked, shocked I tell you!” when this morning’s release of the University of Michigan’s Consumer Confidence Index fell to a 5 month low of 76.8 in September from a consensus call for 82, marking it the largest miss to expectations on record. It is interesting to note that prior to the 2008 credit crash, 4 years into economic recovery a “normal” consumer confidence reading would average around 100, and readings in the 70’s were registered only in the depths of economic recession. Welcome to the new normal were consumers have been stuck in a range between horrible, ok and bad for the last 5 years.

In a related disappointment, consumers expressed their pessimism in August by shopping less for back to school, with today’s US retail sales growth coming in at just .2% (half of what had been predicted.) Since US economic growth is heavily weighted on consumer spending, these drops suggest more downside to GDP forecasts.

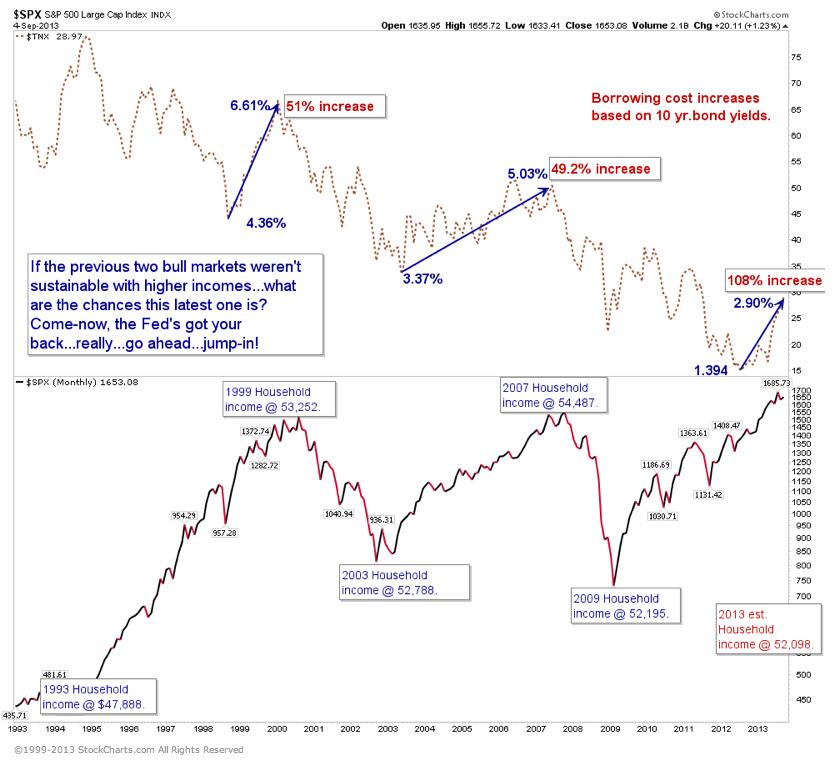

Why in the world would the average bear be pulling back on spending and expressing concern about their economic prospects from here? This chart of the US 10 year treasury yield offers the obtuse a clue. Mind the spike: over the past year, this benchmark rate has more than doubled, driving consumer credit rates higher as the 30 year mortgage rate rocketed up 40% year over year–35% just since May.

Chart Source: Cory Venable CMT, Venable Park Investment Counsel Inc.

As a point of reference on the above picture, note that increasing yields are the norm over the course of an economic expansion, but the typical rise is some 50% over the average 4 year expansion. In our current freakish cycle, we saw rates fall throughout the 4 years of so called expansion, only to rise 100% in the past 12 months just as the economy was weakening once more. In addition, this violent jump in rates is coming as workers have seen no real wage gains in decades and remain highly encumbered with various forms of debt. No wonder the masses are feeling a little weary.