You really can’t go a day without hearing or reading the self-serving, dumb nonsense served up to a vulnerable public by the investment sales crew today. This is especially the case since the last 10 months of monetary experiments and record leverage in financial traders have produced anomalous price gains for the most reckless methods and actors. The cruel irony of such periods is that those exercising valuable risk management discipline, care and accountability have always seen their performance lag in periods dominated by speculative madness. Often this causes people to make early and erroneous declarations of victory and failure where neither is yet deserved. Similar perceptions have emerged at every other valuation peak in history–most recently in 2000 and 2007/08.

What is even more dangerous this time, is that because interest rates are the lowest we have seen in many decades, people are being lured out the risk curve to reach for yield at exactly the most dangerous time–facing huge personal risk to reach for pennies in front of steamrollers. Worse, most financial advisors are pushing them out there.

This article in the Globe last weekend is a perfect example of the extremely dangerous logic being used on the gullible today by the investment community. Here an advisor explains that his “concern about longer lifespans and his bearish outlook for bonds make him comfortable with even higher levels of stock market exposure for retirees. “I’m prepared to go 60-40 [stocks-bonds] or even 70-30 for someone who is in their early 70s and can tolerate some risk.”

He is “comfortable” he says, passively plopping 60-70% of retired client savings into assets that typically lose 30-50% of their value in the cyclical bear phase of each 5 year market cycle. If they understood this is what they were paying handsome fees for, I doubt there is a sane working 50 year old who would be “comfortable” with such a strategy for their life savings, never mind a 60 or 70 year old retiree that has already stopped working!

Moreover, while the TSX remains 16% below its 2008 peak (5 long years ago) and 10% below its commodity bounce peak in 2011 [but never mind–the financial types will assure everyone that they have been making great money: “put your head in this vice here and I will show you how negative real returns over 5 years and even 13 years for the S&P add up to you making money” they say, “who are you going to trust, my glossy reports or your own arithmetic?”]

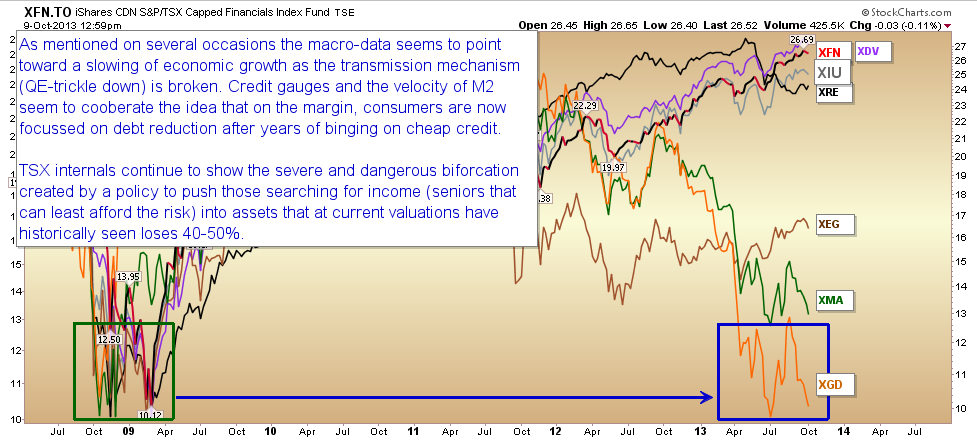

The reality is that the only sectors that have been holding up the TSX even at its current levels are the now extremely overbought and over loved interest sensitives: REITS (XRE), financials (XFN) and utilities(XDV) shown below. And every cycle these defensive names lag but then recouple with the other leading sectors like energy, materials and mining (see green box where they all bottomed in 2009 and blue box they have been moving back towards since 2011 below). Over the past 5 months, the REITS (XRE) have begun to hear the sirens song and have made some progress, moving down 20% so far. The Canadian financials now have the distinction of being some of the most over-valued assets in the world today (along with QE-juiced US stocks).

Unfortunately as always, crazy price gains have served to make the dumb and the reckless the most “comfortable” and risk-exposed they have been since 2008.

Chart source: Cory Venable, CMT, Venable Park Investment Counsel Inc.