Waiting for speculative fevers to break in financial markets can feel like running up a steep hill in the dark. You know the peak is ahead, you know the downhill stretch with feel like heaven on the other side, but you have no idea how much further you have to endure to successfully stay on course and conquer the summit. It is a mental test that the majority of our peers and other market participants fail miserably every 5 year cycle, as they race confidently ahead near market tops only to fall many years behind in the mean reversion on the other side of every peak.

Yesterday in a moment of rare candor, Dallas Fed President Richard Fisher noted concern over what he called the “eye-popping levels” of some stock market metrics today that have not been seen since the “dot-com boom of the late 90’s”. Ah yes 1999, I remember it well, the euphoria was practically unanimous. The analysts, business leaders and finance types all agreed: computers had revolutionized the global economy and a “brilliant” interventionist Fed under Maestro Greenspan, had abolished the business cycle and would never let stocks and high yield bond prices go down again… It was a heady time indeed. Precisely why it set up for the second most spectacular capital drubbing in market history (second only to the crash of 1929).

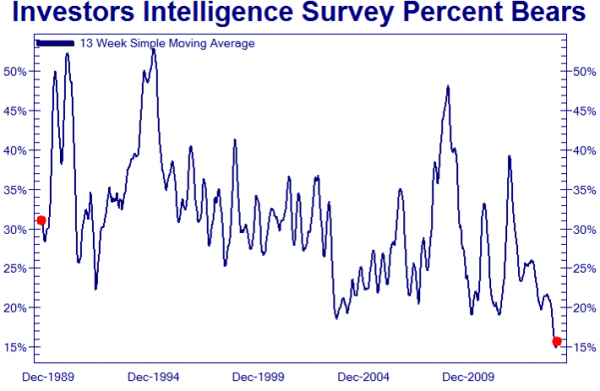

And yet, if one imagined that two 50%+ capital wipe outs in just the past 14 years since 2000 might still be in memory, you’d be wrong. Today’s bulls are stampeding more confidently than in 2000 or 2007. As shown in the chart below, bearish sentiment is now at the lowest levels recorded in more than 25 years. Bears today are practically extinct.

Either the bulls are right and this time is different at long last, or the mean reversion on the other side of this spectacular summit in asset prices is likely to bring generational investment opportunity to those brave souls who can retain mental strength, stay liquid, avoid the madness of the crowd and achieve their just rewards on the other side of the summit once more.