The HSBC Flash China Manufacturing Purchasing Managers’ Index™ (PMI™) is the earliest available indicator of manufacturing sector operating conditions in China. In March the reading contracted below 50 for the 3rd consecutive month, now at the lowest level in 18 months.

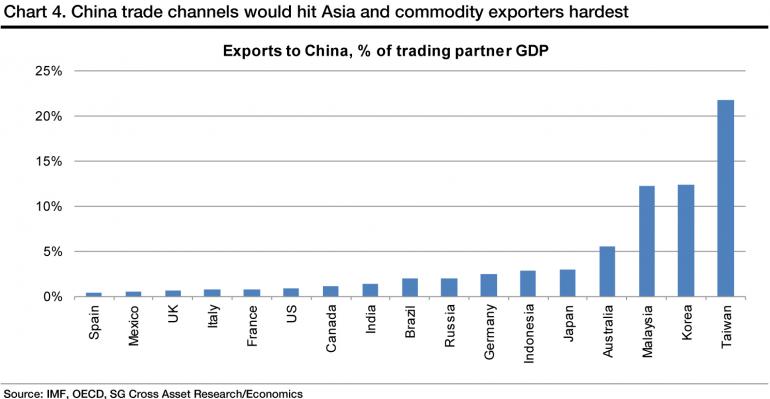

During the past five years, China accounted for 43 percent of worldwide growth. Now swimming in debt and liquidity constraints thanks to Foreign Reserves that have been mal-invested in risk markets and pledged multiple times over, a necessary slowdown of investment by the Chinese government is reverberating around the world. From Australian miners to South Korean consumer electronics manufacturers, the major beneficiaries of China’s astronomical growth are now the most vulnerable. See: China’s economic hard landing.

Years of poor policy decisions encouraged by a decade of record commodity sales, have left Canada particularly il-prepared for this slowdown. Ray Dalio of Bridgewater Investments recently explained why the next decade is likely to prove a disappointing one for the Canadian economy. See: Hedge fund legend warns of a decade of risk for Canada.

“For more than a decade major global macro pressures have benefited Canada on an absolute basis and relative to the U.S.,” but those conditions “have now left the Canadian economy unbalanced and at significant risk for the next decade.”

The hedge fund firm says Canada’s commodity-dependent economy is in trouble because it is “one of the highest cost producers” meaning that capital investment by energy producers will go to lower cost countries.

“The rest of the Canadian manufacturing economy has been hollowed out to a significant degree due to years of underinvestment, as the commodity-driven surge in the currency made other industries unprofitable,” the note says.

In addition, there is the continuing concern about Canadian households’ high debt levels, and the box that puts the central bank in.

The economy might require further stimulus in the form of interest rate cuts, but lower rates would feed the housing market and borrowing by overburdened consumers.

“Therefore, our likely outlook for Canada is a lagging economy that is just beginning a needed de-leveraging in order to re-balance,” the note says.

American economist Jim Rickards recently explained more on the the downside of the “China Miracle”. Here is a direct video link.