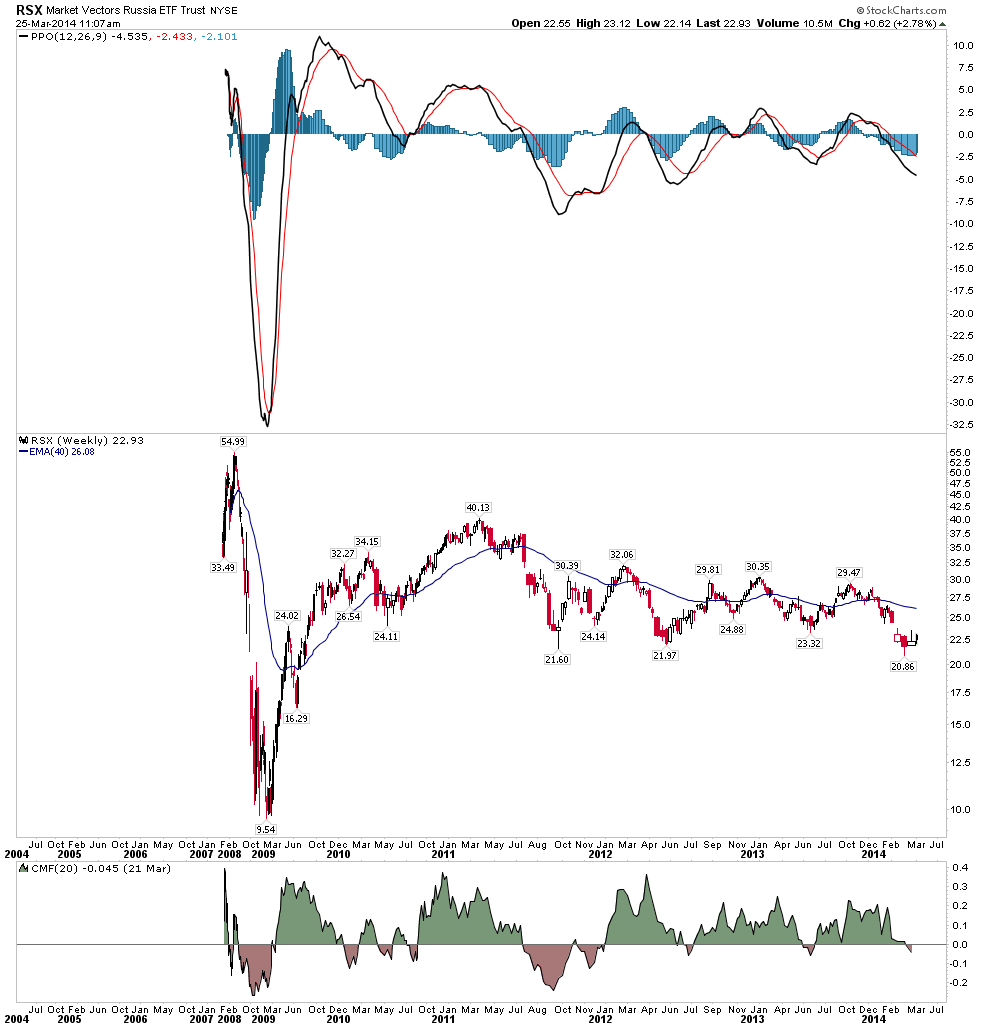

A playground of “hot money” traders the past couple of years, the Russian stock market offers a helpful big picture on the math of loss and investment returns.

After losing 82% of their value from 2008 to 2009, Russian stocks rallied with the rest of global markets into the spring of 2011 gaining back 55% of their down cycle loss. Only to resume decline as global growth turned down once more despite QE mania out of Central Banks. Now down 50% from their rebound peak in 2011 and on the verge of the next economic recession, a downside test toward the 2009 lows (as other commodity-centric sectors have done) may well lie ahead. The universal truth is that highly levered economies and markets leave no buffer for unexpected hurdles or disappointing results; when those buying your securities are not investors but “traders” prices tend to readjust at the lightening speed of margin calls, leaving financial havoc and stress in their wake.

“Even before its standoff with the West, some analysts were predicting Russia would fall into recession.

But now banks, including state run VTB Capital, say EU and US sanctions imposed for Moscow’s incorporation of Crimea, are likely to tip it over the edge.

VTB expects the Russian economy to shrink for at least two quarters as penalties bite.

Latest figures also suggest a slowdown. Russia’s main stock index has dropped by around 12 percent since the start of the year. The rouble is the world’s second worst performer against the dollar. While capital flight, which has risen recently, is expected to rocket because of the crisis.” Here is a direct video link.