Federal Reserve Bank of St. Louis President James Bullard has an ambitious plan about the expected timing of the Fed’s tapering and the trajectory of the U.S. recovery. Bullard sees rate hikes beginning in Q1 2015 and returning to normal (which he defines as 4 to 4.25%) by 2016. (so a 1600% hike in less than 2 years from current .25 levels. All priced in to stock and debt markets at these levels do you reckon?) See the interview here.

The US yield curve does not seem to be agreeing with a more robust growth outlook however. As charted below, since January, the 10 year US Treasury yield has been moving higher while the 30 year yield has moved lower. This partial inversion is seen as a recessionary indicator because it denotes that investors see capital gains potential in longer bonds on the assumption that the economy will slow and rates will fall in the months ahead. We saw similar curve flattening moves heading into both the 2007 and 2000 recessions.

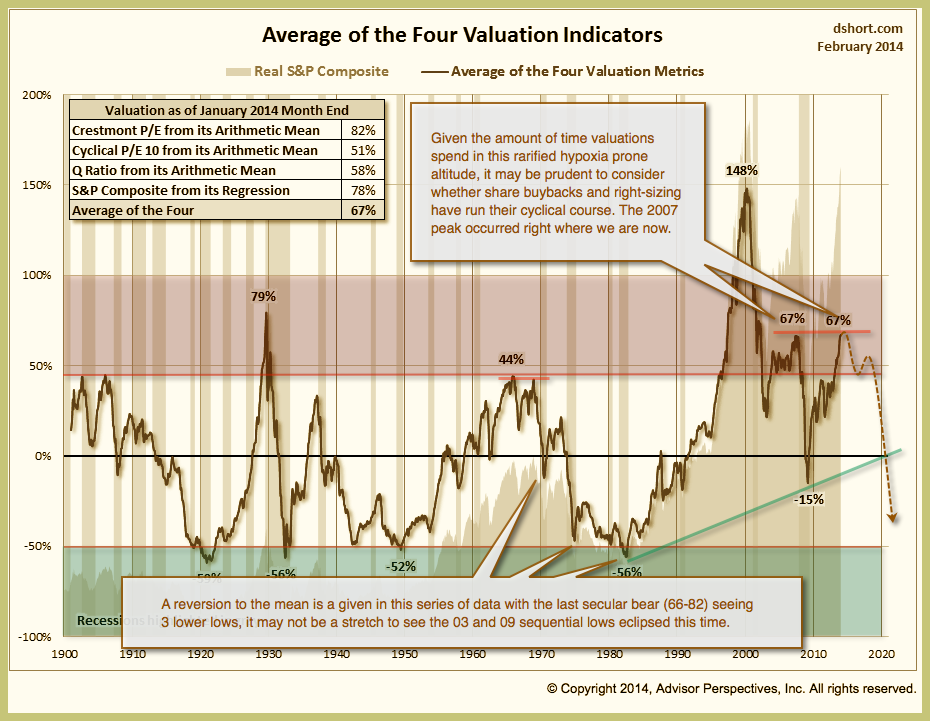

Bullard admits he is one of the more optimistic members of the Fed. That may help explain why he sees no imminent risk or bubble in stocks today relative to other bubble peaks like 2007, 2000 or 1929. Well actually, as shown below, over-valuations were only worse than today for a short time heading into 2000 and before the collapse of 1929. Nothing to worry about here right?