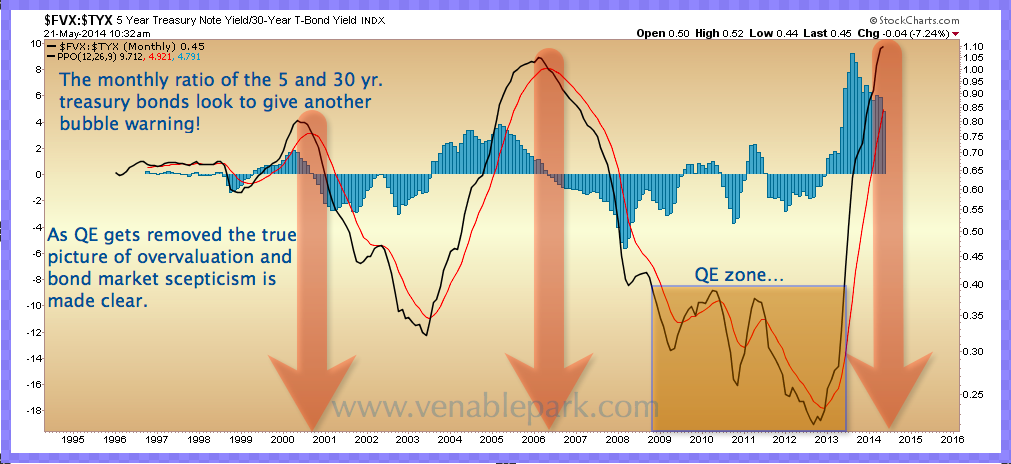

If the bond market believed the almost unanimously bullish economists today, then capital would not be moving from 5-year Treasuries (yields rising as prices decline) into 30 year Treasuries (yields falling as prices rise), but as shown in the chart below, this is precisely what is happening. As we can see, the same ‘bearish of long-term growth prospects, the Fed won’t be able to raise rates as growth plummets’ warning sign emerged at the stock market peak in both 2000 and 2007…

Follow

____________________________

Cory’s Chart Corner

Load MoreGreat read...enjoy! h/t @kdaniellepark

Danielle Park @kdaniellepark

Danielle Park @kdanielleparkhttps://jugglingdynamite.com/2025/04/14/rough-ride-exacting-a-toll/ Rough ride exacting a toll

Preliminary estimates show that the University of Michigan's consumer sentiment for the US plunged to 50.8 in April—below forecasts of 54.5—and the lowest level since June 2022. Consumer sentiment has fallen 40% since Nove...____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In