China’s consumption of metals and materials the past decade was awesome to behold. Its joining of the World Trade Organization in 2001 happened to align perfectly with the first leg of the US Fed’s aggressive monetary interventions following the stock market implosion of 2001. As interest rates were held down at 1%, the resulting western credit bubble was the demand that kept growing for cheap Chinese exports. In typical human exuberance, Chinese investment ramped up capacity to serve what was touted as an insatiable need for more and more consumer goods. Those selling the China story, marketed the “Chinese growth miracle” as the natural product of 1.3 billion Chinese people all striving for western-style comforts.

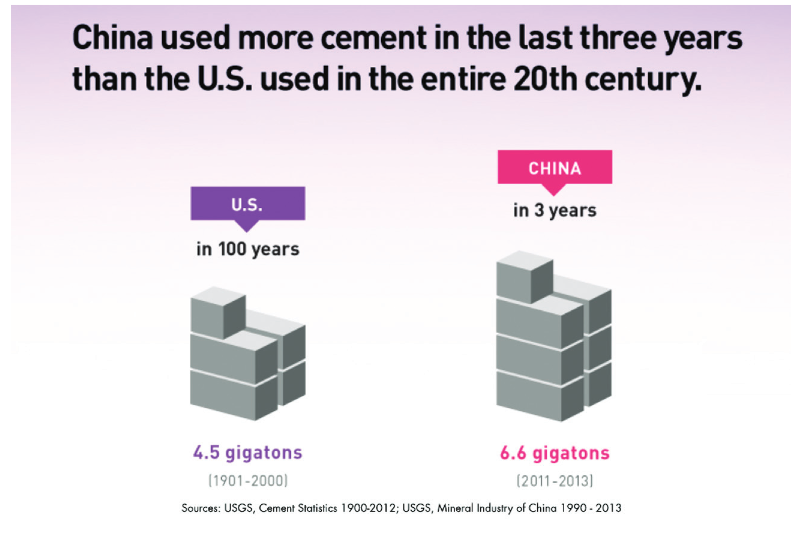

Except that was wrong. The Chinese growth miracle from 2001 to 2008 was born of the largest ever consumer debt bubble in the west. When the debt bubble imploded in 2008, Chinese officials decided to invest capital reserves into keeping their workers busy. The theory was “build it and they will come back”: if they could keep demand steady and build up capacity and infrastructure at home for a year or two, they imagined the west would bounce back and torrid growth could continue. Over the past now 6 years, the Chinese government has prostrated itself, re-pledging its assets over and over, waiting and watching for that delirious western demand to resume at any moment. The below chart of their demand for cement the past 3 years, gives some perspective on how intense their infrastructure and development over-investment has been.

Except western demand has not bounced back. Western consumers continue to hobble under weak employment, stagnant wages, low equity and still heavy debt loads. Americans now have an aversion to debt. They dream of garage sales and storage wars, of spending less and building up savings. And there is an increasing new interest in buying American grown goods and services where possible. As is so often the case, this reversal of fortunes the past 6 years has been a great surprise to the unsuspecting China perma-bulls. This new report on China’s ghost towns, reminds of the scope and scale of the excess capacity and mal-investment now wasting idly away in China. Better luck next cycle…

China’s own Big Apple may be rotting from the core. A new central business district modeled after New York City is going up in Tianjin…but the nation’s slowing economy is exacerbating the risks from its unprecedented credit binge…and that’s putting China’s Manhattan project in jeopardy. Here is a direct video link.

(All of which reminds me of some embarrassing assertions made by Dundee’s Ned Goodman on an investment panel I did with him in 2013 (clip is here) where he was saying the Fed would never tapper QE in his life time (at 1:30 min) while talking up insatiable Chinese growth and confidently assuring the audience that there were no such thing as Chinese ghost towns (see our exchange starting at 6:58)…hmmmm).