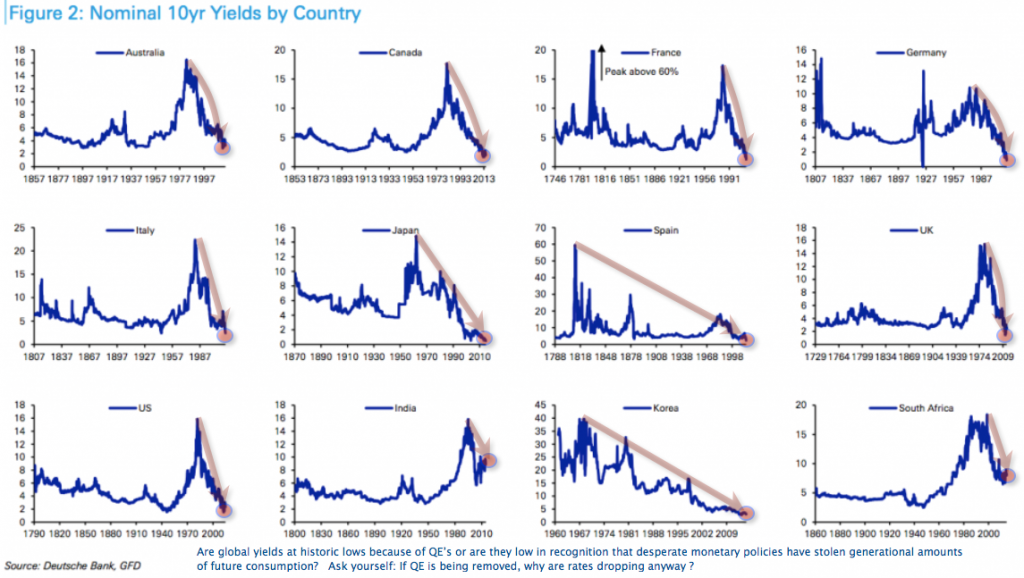

We know that we are living through an era of the lowest interest rates in our life time. But beyond that it is hard for most to get perspective on how the current rate environment compares with the past couple of centuries. The chart below offers help as it plots nominal 10-year treasury yields for 12 of the world’s largest economies for the past 200+ years. (click on picture for larger view)

What stands out is the fact that rates peaked in the western world in the early 1980’s as the bulk of the baby boomer generation (born 1946 to 1964) moved through their peak household formation and spending years. Where their parents had rented and lived with relatives to get started without debt, the baby boomers were inclined to borrow money to consume and spend faster. Like introducing steroids to previously natural cells, the magnified spending power of this massive population cohort initially drove demand for housing and goods to a previously unimaginable level. It also drove up the price of money (interest rates) in the process into 1980.

But once the bulk of the boomers were established with homes and cars and collectibles, demand for money began to fall, driving down inflation and interest rates for the next 30 years and counting. At the same time, falling rates made financed goods continually more affordable for everyone from students to boomers and pensioners. Modern finance, multinational corporations and technology all rose to the opportunity to create more and more complex ‘derivative’ debt products which allowed more people to consume more on debt than at any other time in human history. It seemed like a miracle stimulant for insatiable growth for a long time. But debt is future consumption denied and so each boom year left less demand ahead. By 2006 household consumption literally became paralyzed by its debt and demand plunged all over the world. The debt miracle had run into its inevitable demise.

Over the past 6 years, yearning for the boom years, central banks and governments have tried to restart another consumption frenzy by adding more leverage and more taxpayer-funded cash into the financial system. But their debt rescue boat has punctured leaks in itself. Now not just households, but governments and corporations too are stagnating in the debt and the slow growth era we have purchased in the process.

Interest rates have settled back to historic lows today not because of QE or other ‘free’ money policies, but because the free money elixir has run to the end of its efficacy. No one wants to borrow money, we are sick on debt. And the wealthiest consumers are now old and wanting to downsize. The world is awash in more non-productive goods than we can use. And those who are not, lack the discretionary income to buy them.

This suggests a few more years of weak demand, disinflation, deflation and low rates to come, as debt is slowly written off, paid down and moved out of our systems.