From bubble-mania pricing in the summer of 2011, silver and gold have continued their mean reversion tumble as the US dollar has strengthened against all (well nearly all) forecasts.

The following big picture charts of silver and then gold offer a glimpse of where secular support for each now lies. After already falling 62% since 2011, silver could revisit the $8 to $10 range it held in the multi-asset meltdown of 2009.

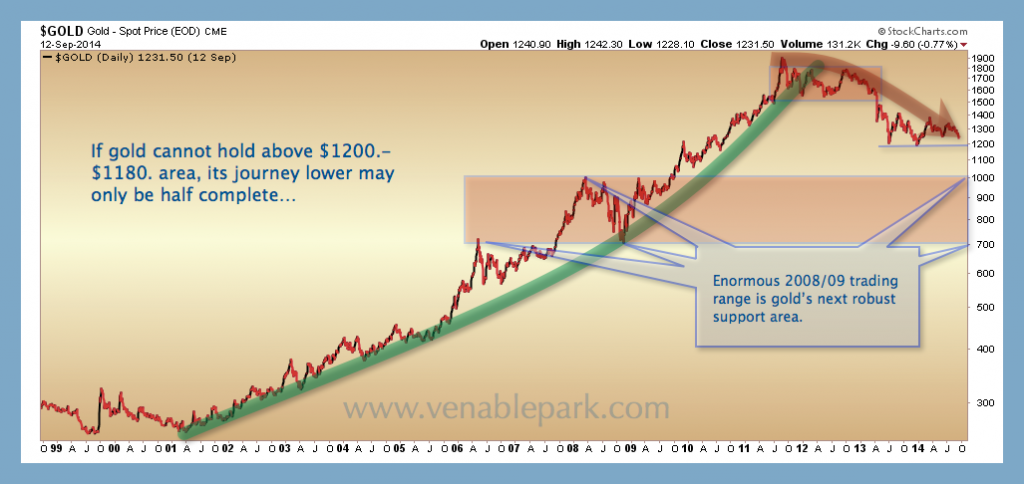

For gold, already down 35%, secular support range remains the $700 to $1000 range.

If prices can hold there, some value may present for longer-term investors. If not, then lower lows are likely to sicken even the most passionate believers. If previous historic, speculative episodes prove a guide, precious metals may disappoint for several years more to come.