“…how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

— US Fed Chair, Alan Greenspan, in a televised speech “The Challenge of Central Banking in a Democratic Society”, on December 5, 1996.

I have been in this business a long time and pretty much seen it all. Over the past 18 years since the Greenspan-led Fed first alluded to irrational exuberance in financial markets and then decided to embrace asset bubbles as a monetary tool rather than take proactive steps to help deflate them, we have lived through one after another spectacular boom and bust. Each time the real economy and median household wealth has fallen further behind.

There is no doubt that a few participants in each bubble have found themselves like lottery winners, holding the right asset at the right time, and able to cash out before collapses hit. Most often these winners were early entrants and promoters who sold their story and holdings to others as prices spiked. The vast majority of participants however have not found that kind of luck, and have ended up holding Ponzi-like assets as prices evaporated.

The commodities bust in 2011 was just the latest painful episode for many. I well recall the buzz and lust for rare earth metals that swept the sector in early 2010. I took a look, did some math and quickly deduced that the valuations and risk/reward ratios made no sense. Many others took the bait.

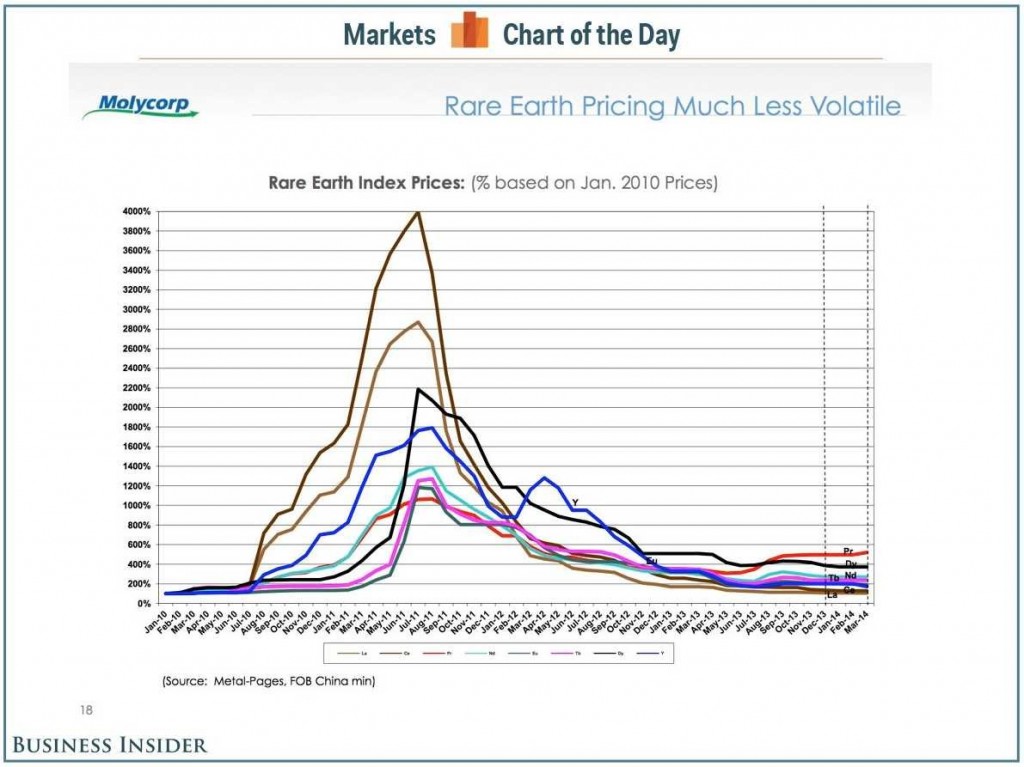

“Back in 2010, rare earth elements were supposed to be the “can’t lose” investment of the decade. Rare earth elements are hard to mine and are used in a wide variety of consumer products like plasma TVs, magnets, and high-efficiency light bulbs.

But despite the seemingly obvious supply-demand dynamic driving up the price of rare earth elements, eventually the price bubble in these commodities got inflated quickly and deflated aggressively.

And now, Molycorp, one the largest rare earth mining companies, is teetering on the edge of penny stock status, while the price of rare earth elements has recovered just slightly.”

See: Remember the commodity bubble that exploded in 2011?

As we can see, anyone who was in early and sold into the frenzy of 2011 won big. Everyone else was decimated. Such is the very nature of asset bubbles. They are so extreme and irrational in their price moves that no one can predict how far they will go or when they will collapse. But collapse they always do. Unless one successfully wagers on the luck of an ideal entry and exit point, or uses insider trading or other illegal acts to reap timing advantage, asset bubbles are pretty consistently deadly.

Those buying and holding other bubbling assets today should ask themselves the question: what is my exit plan? which approach am I banking on? How much of my life savings am I wagering in the process? And how will my life be impacted in the overwhelming probability that I will not get out before the next collapse.