As Germany auctions 2 year bonds today with a negative yield, and the media counts down the seconds to the next pronouncement from central bank oracles, this article on the deforming effects of ‘free’ money policies is worth reading, see: Power of zero rates to distort markets should worry central bankers. Ultra-Loose Policy Storing Up Losses and Volatility for the Future.

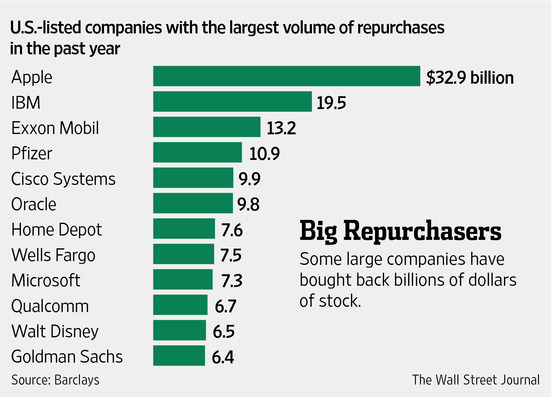

In a related outcome, corporations have continued to borrow record amounts at low rates to buy back their own shares at the highest stock valuations in 6 years. See: Companies’ Stock Buy-backs help buoy the market, even as trading volumes plunge and the liquidity pool grows ever shallower for those now in.