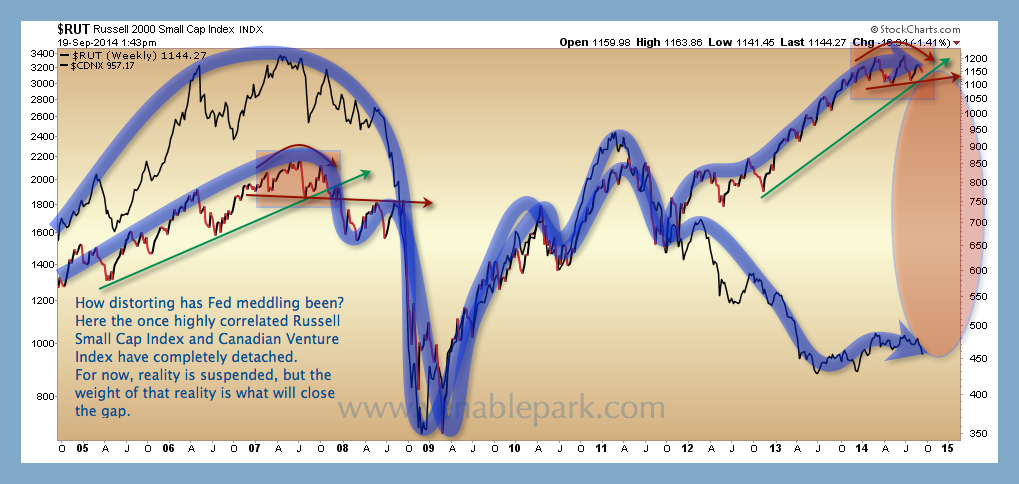

In the time before the double-down pump and dump scheme released as “Q’Ever” in 2012, small cap resource companies that trade on the Canadian Venture Exchange Index used to move in strong correlation with the US based small cap Russell 2000 Index.

As shown above, this historically positive correlation went negative over the past 2 years, as the Russell (top line) disconnected from the Venture (bottom line) and the real economy, and levitated along with large cap indices. But then the plot thickens: over the past 3 months, the Russell decoupled from the large caps once more, and is now negative year to date. If the Russell were to recouple with its Canadian cousin from here, the downside for US small caps is about -50%. At that point, they are much more likely to present some value worth owning.

As shown above, this historically positive correlation went negative over the past 2 years, as the Russell (top line) disconnected from the Venture (bottom line) and the real economy, and levitated along with large cap indices. But then the plot thickens: over the past 3 months, the Russell decoupled from the large caps once more, and is now negative year to date. If the Russell were to recouple with its Canadian cousin from here, the downside for US small caps is about -50%. At that point, they are much more likely to present some value worth owning.