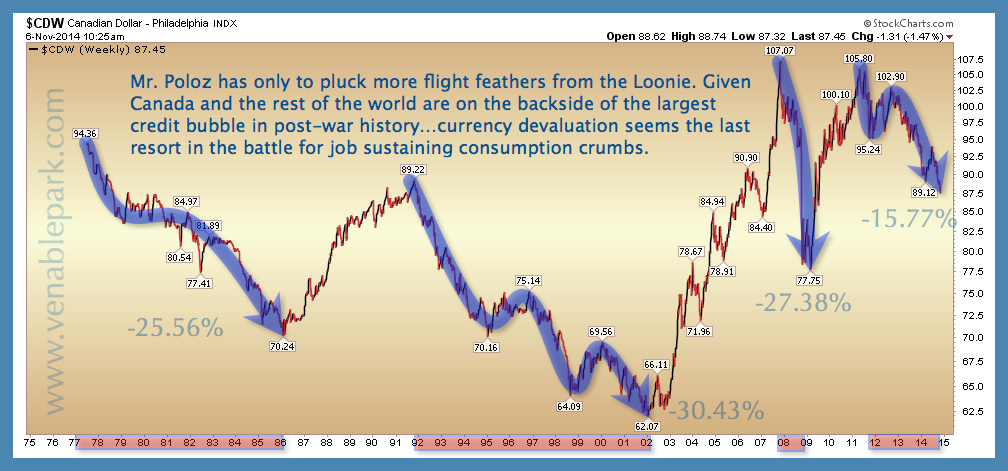

Today the Canadian dollar index (CDW) has broken to a low last seen in November of 2008 when the great financial crisis was humbling bankers and halving global asset prices. This time around, stock markets have barely begun to decline and the Canadian housing market remains outrageously over-valued with household debt (and Canadian bank shares) at all time highs. With all that yet to unwind, rational minds should ponder, how low could the loonie go this time?

The below portrait since 1975 reminds that cyclical declines in the C$ have averaged 27% and lasted about a decade. In this case, the decline that began from 107 on a weekly close in November 2007, was temporarily interrupted by QE-mania from March 2009 to May 2011, and then resumed its descent with global demand. Not sure then, if we should count this as year 7 of the declining loonie trend, or year 4. But in either case, it seems we have considerably further to go both in likely duration and depth for this cyclical decline.