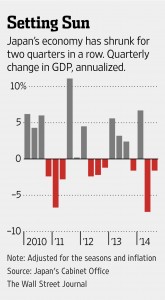

Yesterday Japan reported that its gross domestic product fell an annualized 1.6% in the third quarter, far worse than economists’ estimates of 2.3% growth, and throwing the country into its third recession since 2011.

Yesterday Japan reported that its gross domestic product fell an annualized 1.6% in the third quarter, far worse than economists’ estimates of 2.3% growth, and throwing the country into its third recession since 2011.

Of course, in perennially optimistic form, none of the 18 economists surveyed by The Wall Street Journal had forecast a contraction. See: Japan falls into recession

After 15 years of near zero interest rates (since 1999) and wave after wave of Quantitative Easing by the BOJ (since 2001), the consensus view this morning is that the Abe government was wrong to increase its sales tax last April in an effort to raise much needed revenue. Apparently the Japanese economy is far to weak to pay for its government spending and adding on even more and more debt to the most indebted country in the world is the only plan the consensus can imagine, even though debt levels have long past the realm of reasonably repayable. As usual, debt is presented as the ‘have cake and eat it too’ miracle solution.

The truth is that fiscal and monetary policies the past 15 years have repeatedly saved reckless corporations, executives, bankers and bad debts at the expense of everything else. As a result the real economy, workers, infrastructure, affordable education, proactive health initiatives, the environment, innovation–pretty much everything that actually improves and strengthens civilization–are all suffering from chronic underinvestment and lack of sufficient cash flow today. It’s long past time to admit, repent, reform and recover.

Breakingviews’ Peter Thal Larsen argues Abenomics has even more to worry about. Here is a direct video link.