To hear the finance types talk, you’d think they had invented some new method to grow hydroponic vegetables with a fraction of the water and a zero-carbon foot print or something…

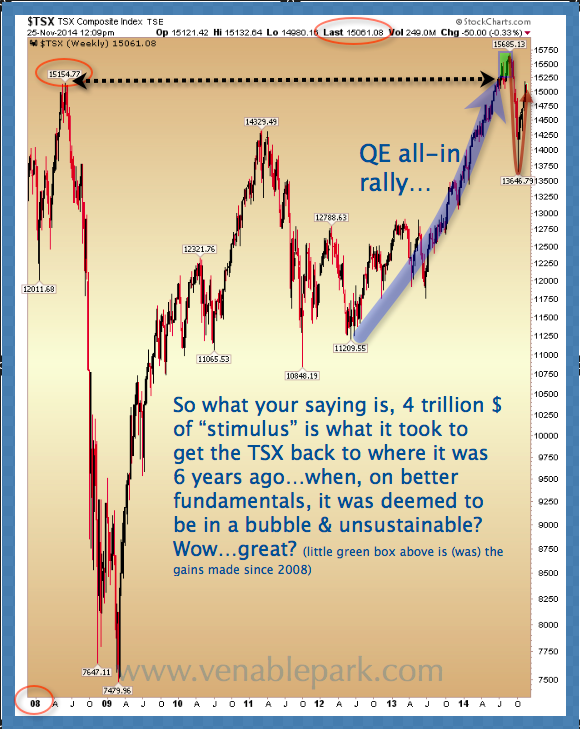

But nope, they have just spent 6 1/2 years trying to make back capital losses, funded by taxpayers everywhere, and are flogging it as investment skill and brilliance…

Fact is that even if stocks can miraculously retain today’s valuation highs (only ever seen briefly in 1929 and 2000 before prices collapsed and spent 25 and 15 years trying to recover); let’s say this time is different…present prices are so far above good investment value that they have now locked in a probable decade of flat to negative returns from here. And that’s without even having them go through a bear market at any time in the next 10 years.

Fact is that even if stocks can miraculously retain today’s valuation highs (only ever seen briefly in 1929 and 2000 before prices collapsed and spent 25 and 15 years trying to recover); let’s say this time is different…present prices are so far above good investment value that they have now locked in a probable decade of flat to negative returns from here. And that’s without even having them go through a bear market at any time in the next 10 years.

Even a best case dream of a ‘permanently high plateau’, begs the sobering question: even if we get to keep this QE-inspired rebound in prices–even counting current portfolio values as permanent money in the bank–what’s the plan to patch up all the gaping holes that still remain in pension plans, budgets and retirement savings now all over the globe?