Good piece from Tony Sagami yesterday looking at the miraculously revised 5% GDP growth estimate conjured this week out of lower spending 0n imports, capex and durable goods. See: Q3 GDP jumps 5%. Ha! The crap behind the numbers.

“I was raised on a farm and I’ve shoveled more than my share of manure. I didn’t like manure back then, and I like the brand of manure that comes out of Washington, DC, and Wall Street even less.A stinky pile of economic manure came out of Washington, DC, last week and instead of the economic nirvana that it was touted to be, it was a smokescreen of half-truths and financial prestidigitation…

Of course, Wall Street doesn’t want little things like facts to get in the way of their year-end bonus. As we close out 2014, the stock market marched higher and ignored things like:

- The reaction of the bond market to the 5% number. Bonds should have softened in the face of such strong economic numbers, but the “adults” (the bond traders) on Wall Street saw the same manure that I did.

- If the economy was as healthy as the BEA wants us to believe, the “patience” and “considerable time” promise of the FOMC should soon be broken… right?

I spend most of the year in Asia, including China, and I am seeing the same level of numbers massaging by our government as China’s. In China, the government leaders establish statistical goals and the government bean counters find creative ways to tweak the data to achieve those goals.

Zero interest rates.

24/7 central bank printing.

See-no-evil analysts.

Financial smoke and mirrors.

That’s the financially dangerous world we live in, and I hope that you have some type of strategy in place to deal with the bursting of what’s becoming a very big, debt-fueled bubble.”

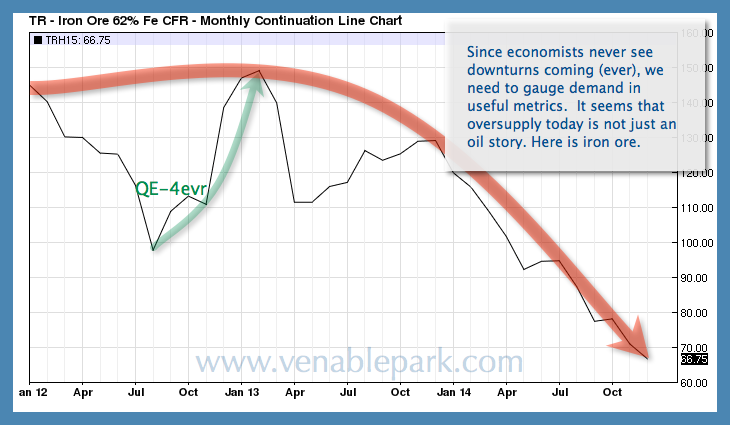

In the real world, oil is down another 3% this morning as the HSBC China Manufacturing PMI contracted to 49.6 in the final reading for December, Venezuela confirmed its 3rd quarter of violent recession and iron ore still can’t catch a bid.