Investment banks have been instrumental in driving investor capital and leverage into the energy sector the past few years. For an excellent primer see: How Wall Street Drove the Oil & Gas Drilling Boom that’s Turning into a Disaster.

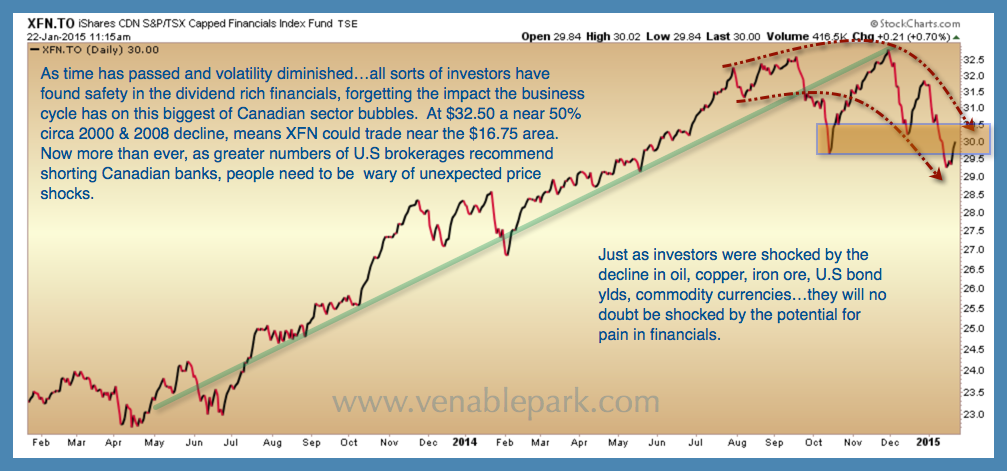

First it was the tech wreck in 2000, then it was the housing bust in 2007. Same players, similar tactics. Now the downside of all that reckless risk-selling looms large for over-indebted energy companies, but also for the banks (and their investors) who are holding toxic securities as prices plunge. This chart of the Canadian financial sector index (XFN) offers a glimpse of where the mean reversion cycle is so far. No doubt the losses compounding for bank investors will be just as violent and unexpected by the consensus intelligentsia, as the collapse in energy has been to date.