Two more rate cuts and more government stimulus efforts over the past 4 months, and still the Chinese economy–weighed by mind-boggling debt and inventory–continues to slow. This massive mean reversion phase has been well earned by the equally massive hyper-investment period that went before it, courtesy of the global debt bubble. We should now expect equal and opposite in the other direction. Slower growth is the new normal, not a phase. See, China: Industrial output, fixed investment, property sales and retail sales miss forecasts

Growth rates for industrial production, retail sales and investment in factories and other fixed assets in January and February came in significantly below economists’ expectations, while housing sales continued their swoon, according to government data released Wednesday. China releases combined data for January and February to limit distortions caused by the long Lunar New Year holiday, which falls within those months but on dates that vary from year to year.

Industrial production, which is seen as a proxy for the country’s economic growth, grew 6.8% in the first two months, its lowest level since the 2008 financial crisis. That is down from 7.9% in December and well-short of a median forecast of 7.6% from a Wall Street Journal survey of 14 economists. Factories were hit by overcapacity, high inventories and tight financing, economists said.

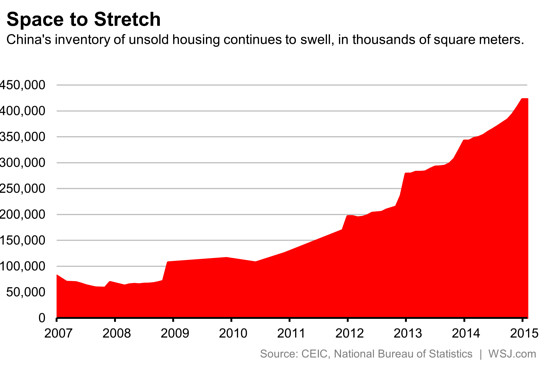

The overall weak performance so far in 2015 showed that the economy was still weighed down by a housing glut, debt and industrial overcapacity…