Massive volatility sweeping through world financial markets. So far this week the US dollar index, stocks and bonds have all lost ground, while commodities have ridden the other end of the capital teeter totter up. As talking heads attempt to explain the moves on a blow by blow basis, an over-arching theme seems likely at work.

First Greek debt talks are back in the midst of another nervous breakdown. There is speculation that Drachmas have already been ordered from Canadian printing company Fortress Paper (see more here) in preparation for a Grexit from the Euro. This has sent the Euro higher against all major currencies as traders bet that an exodus of Europe’s most indebted country (and possibly then countries) may lead to a stronger Euro (weak members go and stronger members stay). This has translated to a falling U$, as levered bets are moved away from the greenback and onto the Euro. The algo-bots that now run rife in global markets, have been programed to see weaker US dollar/stronger commodities as the same trade (ignoring the brutal math of still weakening demand and soaring supply). They also read higher commodities as inflationary and so bonds are simultaneously sold pretty much across the board. Commodity currencies like the Aussie and loonie have rebounded along for the ride.

We have seen similar versions of this sequence play out repeatedly over the past few years only to suddenly reverse again when confronted with the relentless data of a slowing macro picture (deflationary). We shall see if this time is different.

I remain skeptical. Excess inert capital sloshing around the banking system– that no one is spending–cannot make inflation out of thin air no matter how much central bankers target that. And robotic trading systems can’t create consumption no matter how much they ping around in the future’s market. The whole facade is a farce and insiders know it.

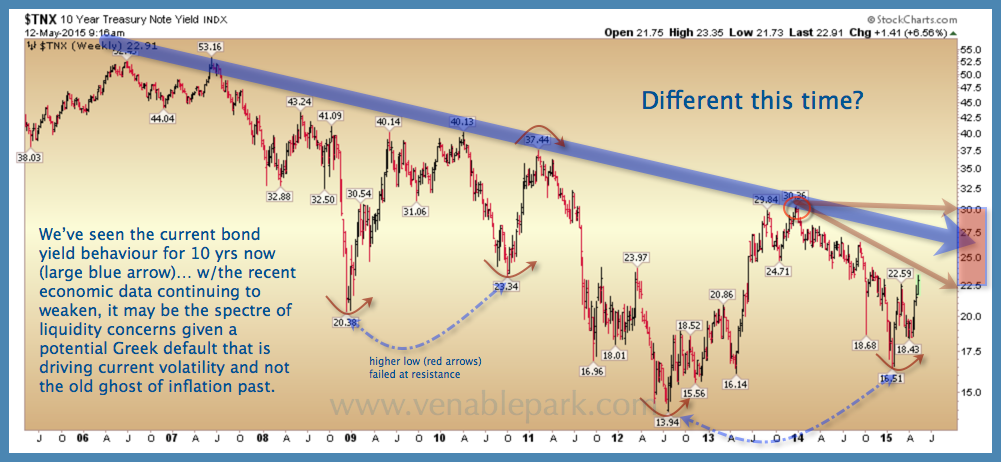

After selling off abruptly this morning, North American bonds are so far rebounding this afternoon. The whole world watches the US yield curve for signs of economic momentum. So far, despite the back up the past couple of months, the downward yield trend persists (as shown below). Short term trading noise aside, unless and until we see significant recovery in consumption, jobs and wage inflation, North American bond yields are likely to remain within the downtrend in play since the US housing bubble burst in 2006.