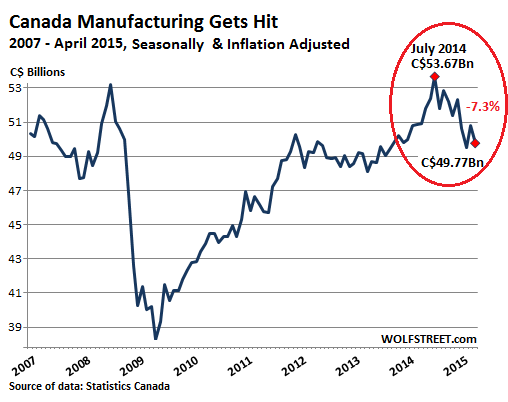

The hype and promise of Canadian growth and stock market bulls has been that lower oil prices would be offset by a surge in export demand spurred by the weakening Canadian dollar. Unfortunately this was a pipe dream. Canada’s manufacturing sales are now down more than 7% since last July–weakness not seen since the beginning months of the 2008 recession. See: Weak loonie not enough to boost Canadian Manufacturing.

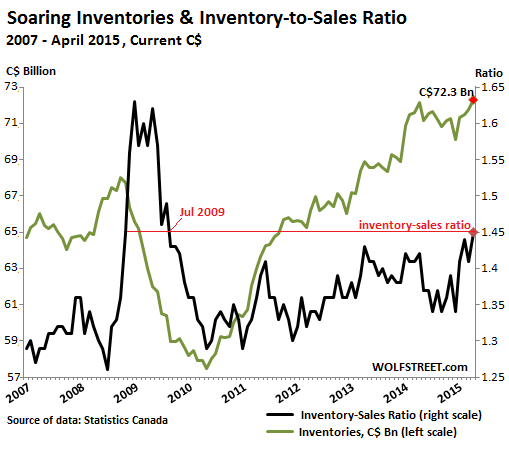

Also perennially optimistic, Canadian corporate executives have similarly overestimated Canada’s prospects, and now sit with the highest inventory levels (green line below) on record in the midst of falling sales. This bodes poorly both for future new orders and prices (revenues). See: Manufacturing in Canada sags, triggers chilling references to financial crisis.

Weak factory sales also suggest that Canadian GDP may have shrunk yet again in April for the 5th time in the past 6 months, foiling hopes that contracting growth in Q1 will significantly improve in Q2.

Weak factory sales also suggest that Canadian GDP may have shrunk yet again in April for the 5th time in the past 6 months, foiling hopes that contracting growth in Q1 will significantly improve in Q2.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In