As the China miracle continues to mean-revert what many in the world had misconceived as insatiable demand, sober insights on the commodities/credit boom now busting in Australia offers similar warnings for Canada and other commodity centric nations. See: First the Miners, now the banks, and then comes property?

For those who still want to believe that the latest commodity super cycle is not yet dead but only pining, we offer the following chart of the resource focused Canadian Venture Exchange, below since 2000. It is well past time to admit facts.

Having fallen steadily since global growth began weakening again in late 2010, the index has now retraced the entire gains of the China story from 2001 through 2008–and then some. At 528 today, shares in this index have lost a collective 84% from the euphoric peak in 2007. Those who were ‘buying the dips’ throughout have been ground to dust.

It’s also important to note, that historically secular booms in commodities are followed by secular busts of 10 to 20 years as the industry consolidates to a fraction of its former self, rightsizing previously frothy household spending, finance and property sectors along for the ride.

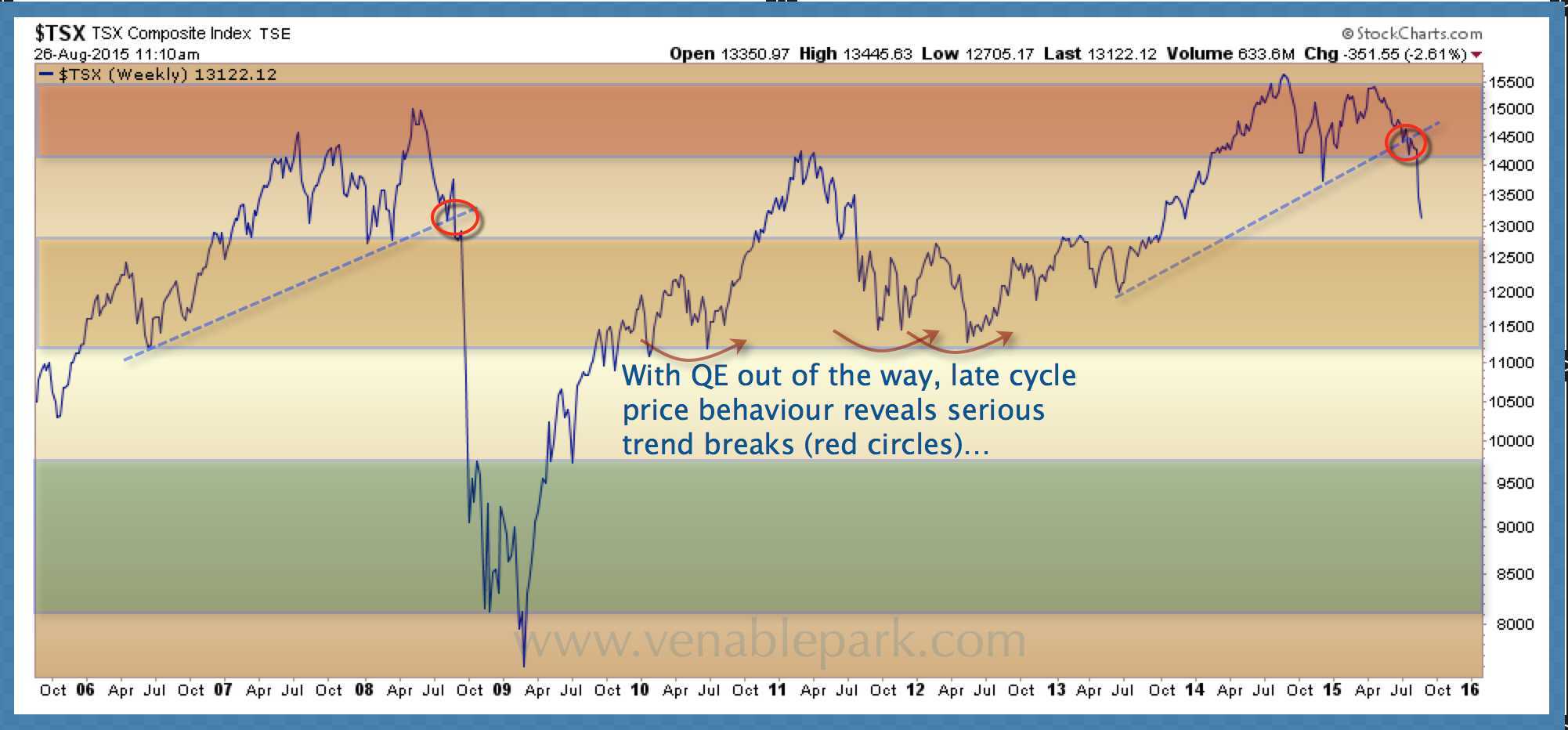

As we consider these implications for the broader Canadian stock market (TSX shown below since 2005) , it is key to comprehend that the 15% decline to date, has still mostly been about losses in metals, minerals and mining, with the accompanying rightsizing of the finance and property sector in Canada, all yet to come. This is why a potential retest of the 2009 lows (green band) and possibly lower, must remain on the radar.