Times are tough for commodity exporters everywhere and Brazil is leading the pack. Having officially admitted it is in recession last month (forecast to be the nation’s worst since the 1930’s), today Standard and Poor’s cut the country’s credit rating to junk status. See: Brazil cut to junk. In a sign of the times, apparently previously flush oil executives are no longer whizzing around the country in helicopters. See: Brazil’s economic crisis is destroying the world’s busiest helicopter market.

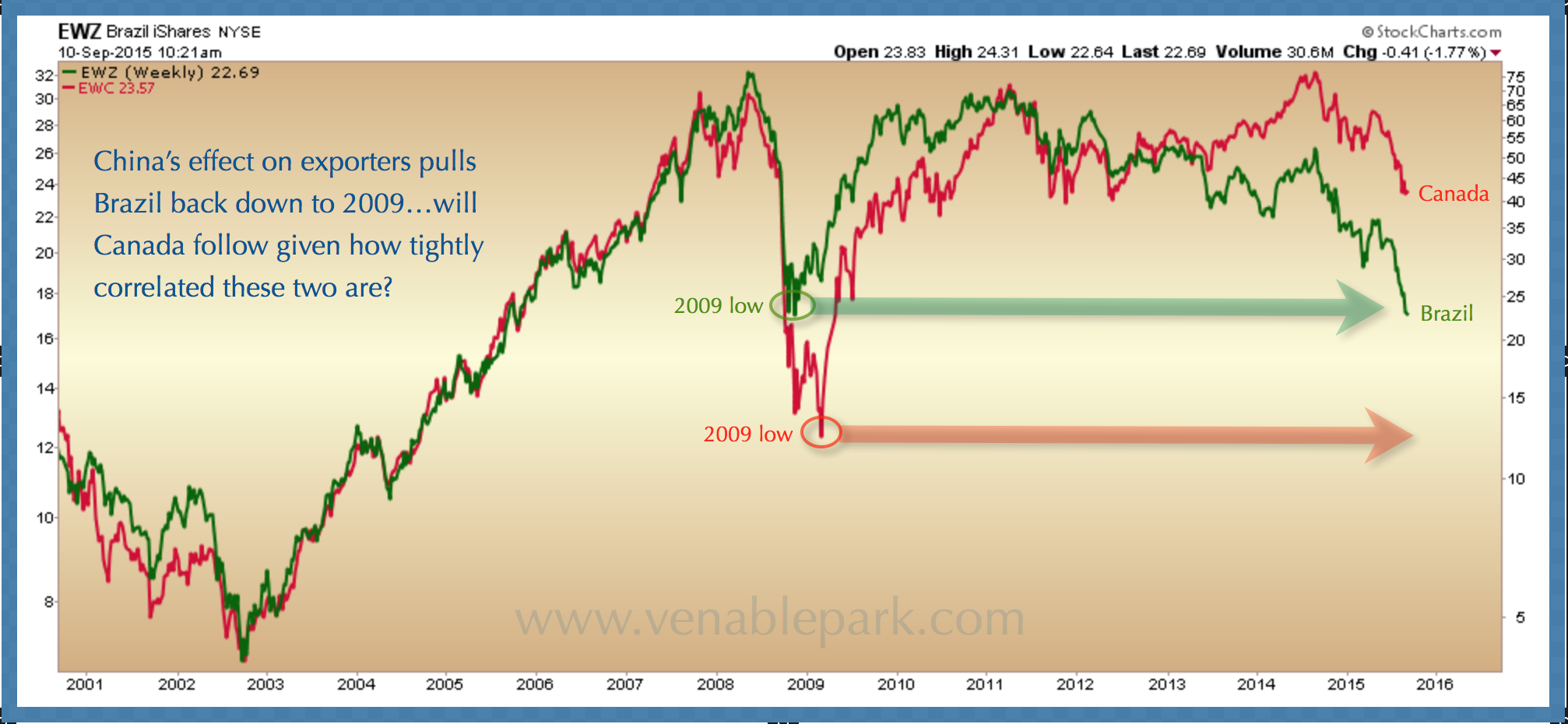

What a difference 7 years can make once debt levels have soared and revenues start crashing. It was just the spring of 2008 when the world seemed mad for commodities and S&P upgraded Brazil’s bonds to investment grade from junk. Today the Brazilian stock market (below in green since 2000) round tripped back to its 2009 recession lows (as we thought that it would).

The question yet to be answered is will other commodity-centric markets do likewise. The Russian stock market is already nearly there. While others like Australia and Canada (in red below) that have been tightly correlated with Brazil throughout, appear to be headed in that general direction. Sure we have less government debt and corruption in Canada, but at the end of the day, commodity prices have always been the tie that binds.