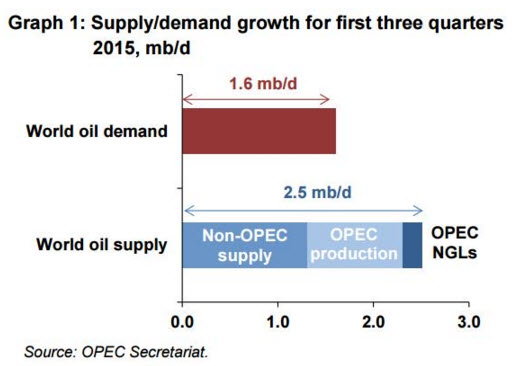

In a nut shell: OPEC says oil-inventory surplus biggest in at least a decade.

And the smarter new world of renewable energy is only getting started. We sure have been painfully dumb on the uptake here:

And the smarter new world of renewable energy is only getting started. We sure have been painfully dumb on the uptake here:

“We are like tenant farmers chopping down the fence around our house for fuel when we should be using nature’s inexhaustible sources of energy – sun, wind and tide. I’d put my money on the sun and solar energy. What a source of power! I hope we don’t have to wait until oil and coal run out before we tackle that.”

— Thomas Edison to Henry Ford and Harvey Firestone in 1931

Here is a direct video link.

See: Energy hasn’t been this hot since they invented fire.

Renewables are no longer “alternative energy.” Solar power is competitive with fossil electricity in more and more places every year—watch China, India, and Chile in 2016. Global demand for the sun reached a new high this year, and solar is that rare thing that liberals and many free-market conservatives in the U.S. can agree to love. Wind power is cheaper than coal in Germany and the U.K., which may close all its coal plants by 2023.

Which brings us back to oil. Prices may stay low thanks to resilient U.S. output, renewed Iranian exports, and Saudi Arabia’s strategy to sell at whatever price it needs to maintain market share. And there’s a funny thing about oil that you might not have noticed. It doesn’t really compete with the other energy sources. It powers cars, ships, and planes. The others generate electricity.

So the true wild card for oil, beyond any 2016 price whips, is how fast cars start to run on electricity instead of gasoline.