ECB’s Draghi is in full PR mode today explaining why what he said yesterday was actually much more bullish for financial assets than what market participants seemed to think yesterday when they sold with both feet. The algos have grabbed the headlines and run US stocks up the hysteria pole (S&P 500 and TSX still negative for the week notwithstanding), while oil (just closed the week under $40), corporate bonds (lower), treasuries (higher) Canadian stocks (flat) and the loonie (lower) are all rejecting a jubilant read.

A few charts to help cut through the noise…

First as US stock prices leap this afternoon, the year over year change in earnings per share for the Russell 2000(small-cap in blue) and S&P 500 (large cap in orange) companies has been falling since 2011 and is negative over the past 15 months.

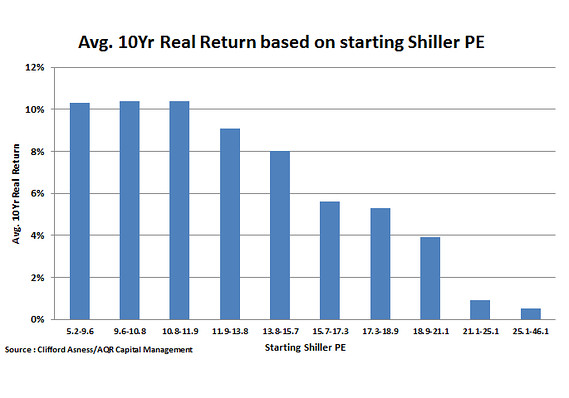

Prices up, earnings way down means the price to earnings ratio for US stocks is at nosebleed highs only bested once in human history at the fleeting tech-wreck peak of 2000. For the S&P 500, the Shiller PE is today an eye-popping 26.39. While the Russell 2000 is trading at a hilarity-inducing 145x earnings! All proof positive that stocks are still stuck within the secular bear that began in 2000. The next, third, and likely to be equally massive (as 2001-03 and 2007-09) cyclical correction is coming folks. Stay-ready.

Prices up, earnings way down means the price to earnings ratio for US stocks is at nosebleed highs only bested once in human history at the fleeting tech-wreck peak of 2000. For the S&P 500, the Shiller PE is today an eye-popping 26.39. While the Russell 2000 is trading at a hilarity-inducing 145x earnings! All proof positive that stocks are still stuck within the secular bear that began in 2000. The next, third, and likely to be equally massive (as 2001-03 and 2007-09) cyclical correction is coming folks. Stay-ready.

Missed in all this madness(as graphed in blue), the S&P 500’s PE of 26 (never mind the Russell’s 145) suggests that annual returns will be zero and less for the next 10 years from current price levels (see far right bar below) and this is even if one managed to hold on through a decade of heart-thumping volatility and collect the meager dividends. Like them apples? You can have ’em. Peace out!

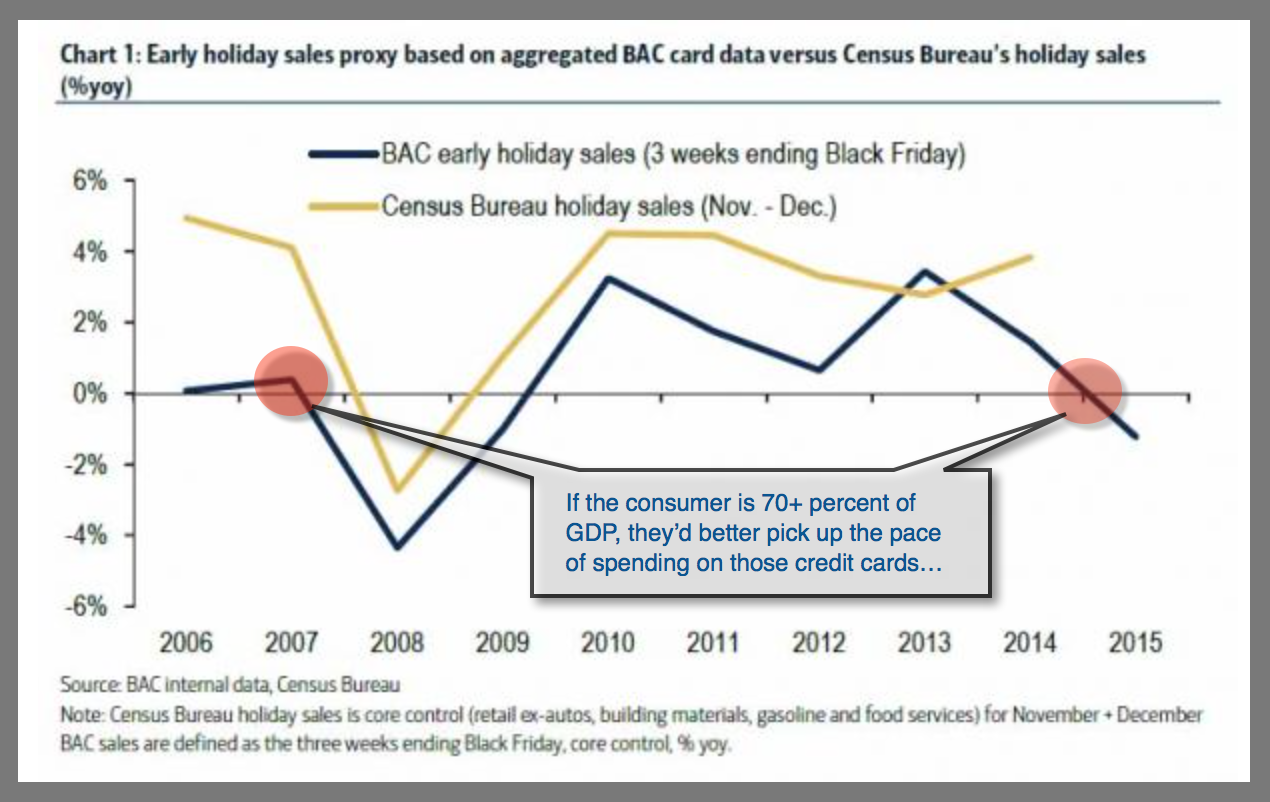

One thing is clear from year over year holiday season sales (in blue below). Shoppers don’t seem to be buying Janet Yellen’s ‘all clear on the western front’ spiel. We haven’t seen them this miserly since the onset of the 2008 recession. Good, because the best present we can give our families is more savings and less debt. Pass it on.

One thing is clear from year over year holiday season sales (in blue below). Shoppers don’t seem to be buying Janet Yellen’s ‘all clear on the western front’ spiel. We haven’t seen them this miserly since the onset of the 2008 recession. Good, because the best present we can give our families is more savings and less debt. Pass it on.