Facts must be faced in order to reform and recover. Sugar-coating polite comments about all of this, is not helpful. This interview is a worthwhile update.

We have roughly 25 of these systemically dangerous institutions in the United States. We have around 35 of these systemically dangerously institutions globally on top of that. So, we roll the dice just in the United States 25 times every day to see when the next one will blow up. . . . The fraud makes things very fragile.” Here is a direct video link.

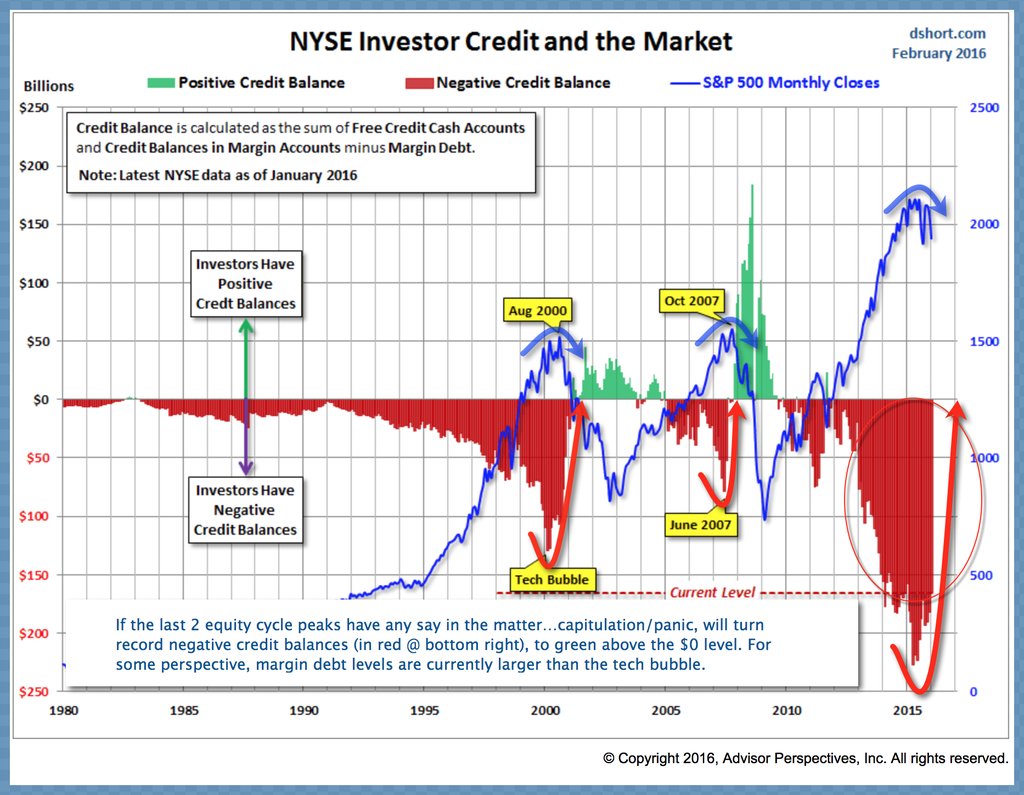

As a footnote, I disagree with Bill’s comment that we don’t have dangerous over-valuations or ‘bubbles’ in US markets today. Here is the recent chart of the S&P 500 (in blue) and margin debt (in red since 1990). If the 2000 and 2007 valuation tops are now considered bubbles (and they are), then today is likely to be labelled a bubble in retrospect as well.