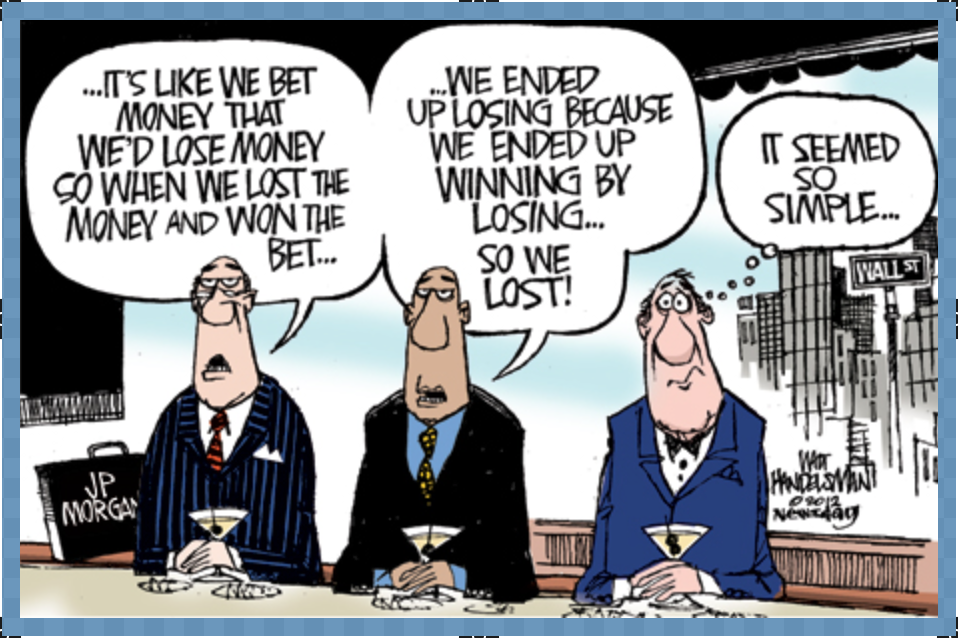

I have written in the past to recommend former BOE head Marvyn King’s new book The End of Alchemy. Michael Lewis also recommends the book as a must read for anyone thinking about ways to fix our broken financial system and move the risk of bankruptcy off the public purse and back where it belongs, on the bankers, their shareholders and lenders. The banks want all the upside on wins, they have to also bear the downside on losses. It’s the only rational policy for adults. And yet, today, 8 years after the financial crisis, still they do not. Important to keep all this front and center as US banks announce their next quarter of earnings hijinks this week.

In his book review, Lewis adds some interesting personal anecdotes (King taught Lewis as a student at the London School of Economics when King was a professor and Lewis not yet a best selling author, famous for ripping the cover of civility off the cesspool of finance.)

In his book review, Lewis adds some interesting personal anecdotes (King taught Lewis as a student at the London School of Economics when King was a professor and Lewis not yet a best selling author, famous for ripping the cover of civility off the cesspool of finance.)

Most of all, for those who aren’t convinced another book on banking is a ‘good read’ for their summer holidays, Lewis does a good job of short-handing the meat of King’s ‘Glass-Steagall-like’ proposals on how to end the era of never-ending financial crisis and restore safety to bank deposits and a financial system as a stable utility in support of the real economy. You can read Lewis’s whole review here: The book that will save banking from itself. Here are some cheat notes:

The first thing that King thinks must be done is to separate the boring bits of banking (providing a safe place to deposit money, facilitating payments) from the exciting ones (trading). There is no need, he thinks, to break up the existing institutions. Deposits and short-term loans to banks simply need to be separated from other bank assets. Against all of these boring assets, banks would be required to hold government bonds or reserves at the central bank in cash. That is, there should be zero risk that there won’t be sufficient cash on hand to repay people wanting to flee any bank at a moment’s notice — and thus no reason for those people to flee.

The riskier assets from which banks stand most to gain (and lose) would then be vetted by the central bank, in advance of any crisis, to determine what it would be willing to lend against them in a pinch if posted as collateral. Common stocks, mortgage bonds, Australian gold mines, credit default swaps and whatever else: The banks would decide, before any crisis, which of their risky assets they would be willing to pledge to — basically, pawn with — the central bank. The riskier the asset, the less the central bank would be willing to lend against it. Any asset so complicated that it couldn’t be explained satisfactorily to the central bank in three 15-minute presentations wouldn’t be eligible as collateral. Everyone would know, if any given bank ever required a loan from the central bank, the size of the loan the central bank would be willing to extend. The central bank would go from being the lender of last resort to what King calls the pawnbroker for all seasons.