Oh Canada…who would’a thought that using huge loans to pay a fortune for housing, cars and everything else would usher in an extended consumer spending slump? Why everyone who is not paid to ignore the math, of course!

Watch this BNN video update with the Assistant Chief Economist for Laurentian Bank found in Weak retail data sends Loonie down.

And don’t look now but realty prices in ‘hot’ BC markets seem to be cooling rather quickly over the past 3 months (starting well before the new 15% foreign buyer tax was implemented on July 25).  As painful as the mean reversion process will be for the highly levered, ignorant or overly aggressive participants who have not seen this coming, a return to rational asset pricing is critical to restoring productivity and consumer demand in the real economy. And the correction is overdue, if to a lesser extent, in property markets well beyond just Vancouver and Toronto. We have well earned the downturn. It was always a question of when, not if.

As painful as the mean reversion process will be for the highly levered, ignorant or overly aggressive participants who have not seen this coming, a return to rational asset pricing is critical to restoring productivity and consumer demand in the real economy. And the correction is overdue, if to a lesser extent, in property markets well beyond just Vancouver and Toronto. We have well earned the downturn. It was always a question of when, not if.

Years of low interest rates have been the problem not the savior. There are only so many income dollars to go around, and if too many of them have been diverted to shelter costs (savings for down-payments, longer running loan payments of interest and principle, taxes, utilities, insurance, maintenance, services) then the cash flow for spending now and saving for the future is necessarily eroded.

In the process, this has all purchased an extended period of slow growth and financial losses for many individuals, companies and financial institutions, along with of course, Canada Mortgage and Housing. See: Is the metro Vancouver real estate market in freefall?

“The median household income in the region was $84,345 in 2011, according to the District of West Vancouver.

“The market in West Van is up 450 per cent since 2001. So is everyone making 600 per cent more income than they were so they can pay their taxes and buy their houses? Of course not. So how has this inflation been financed? By offshore money and record debt.”

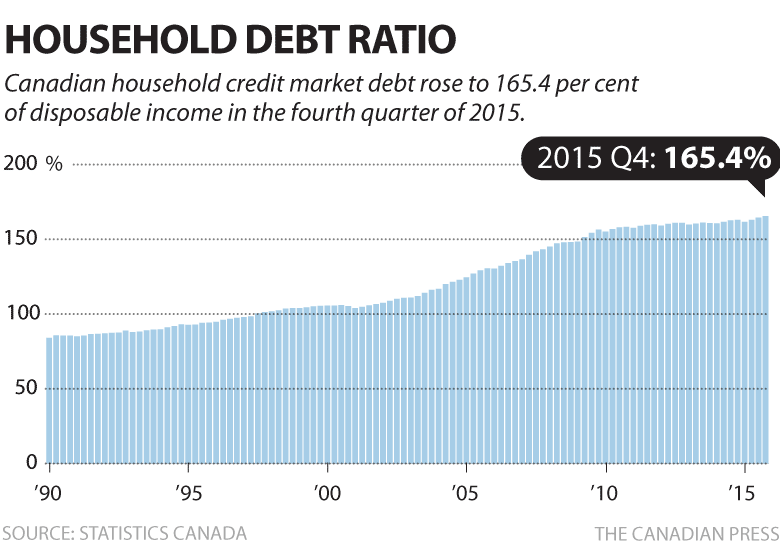

The math is obvious: Canadian income gains have fallen far behind the rise in household debt levels. The ratio reached a ludicrous 165% debt/ disposable income as at Q4 2015. See: Canada’s debt to income ratio sets new record high.

Let the deleveraging catharsis teach us to repent and learn wiser habits.