Good explanation of the weight holding back economic recovery today in this segment. Productivity comes from investment in efficiency, smart resource management and new innovation, not from excessive asset prices and capital waste. Obvious, and yet, ignored for the last decade.

Komal Sri-Kumar, president at Sri-Kumar Global Strategies, discusses the U.S. economy and the lingering effects of the financial crisis.Here is a direct video link.

Here is a second clip.

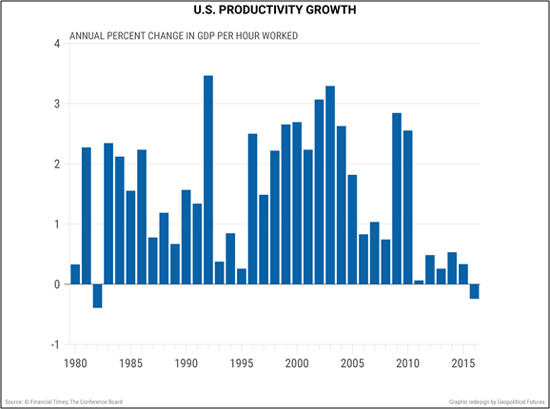

Here is the US productivity growth chart showing stagnation over the past 6 years. Trillions in taxpayer funds and debt have been wasted. Far from helping growth, QE has counter-productively driven up asset prices and driven down yields while encouraging corporations to waste precious resources on financial engineering (just as revenues are in a post-credit bubble secular decline). At the same time it has enabled governments to avoid necessary reforms and infrastructure investment. Question is when can the theorists admit and repent (or be replaced) in order for the economy to finally reform and recover?