China has provided several forms of vendor-take-back financing for the western credit/consumption bubble 2005-2015. First by recycling its export profits back into US and European treasury bonds (which kept rates low and allowed more borrowing in the west), then by funding the world’s largest stimulus program in 2008 to boost global demand in the short run, and lastly in recent years, with capital fleeing China (some legal and some not) to buy up property and businesses in the west.

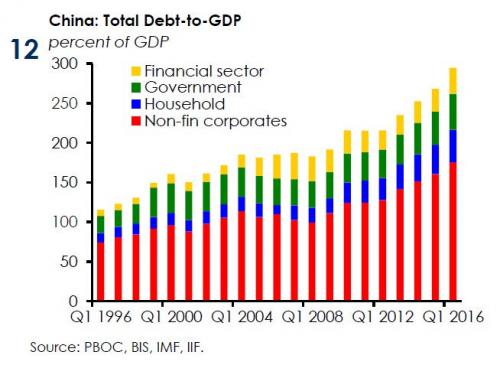

All of these actions have  helped boost official demand numbers and asset prices, but with it, also more superfluous inventories, inefficient allocations of capital, and of course debt on debt on debt. Officially China now has a debt to GDP ratio of 275%+ as charted here. Fitch estimates that loans are going bad in China today at 10x the officially reported rate.

helped boost official demand numbers and asset prices, but with it, also more superfluous inventories, inefficient allocations of capital, and of course debt on debt on debt. Officially China now has a debt to GDP ratio of 275%+ as charted here. Fitch estimates that loans are going bad in China today at 10x the officially reported rate.

As with all extend and pretend strategies that throw good money after bad, they delay, but also magnify, the underlying fundamental problems which require structural reform, debt write-offs and lower prices to clear the excesses of the prior boom.

The below discussion focuses on the steps the Chinese government has taken to paper over growing losses in the banking system while “peer to peer” market place lending (MPL) has ballooned on top of official debt totals. Of course all of the comments made by Cornish are also words of warning to the other countries who have been adding more debt (now globally 35% higher than in 2008) rather than allowing the economy and financial markets to reprice and heal.

Jonathan Cornish, head of north Asia bank ratings at Fitch Ratings, discusses China’s latest debt for equity swap, China’s non-performing loans and the outlook for the credit market. Here is a direct video link.