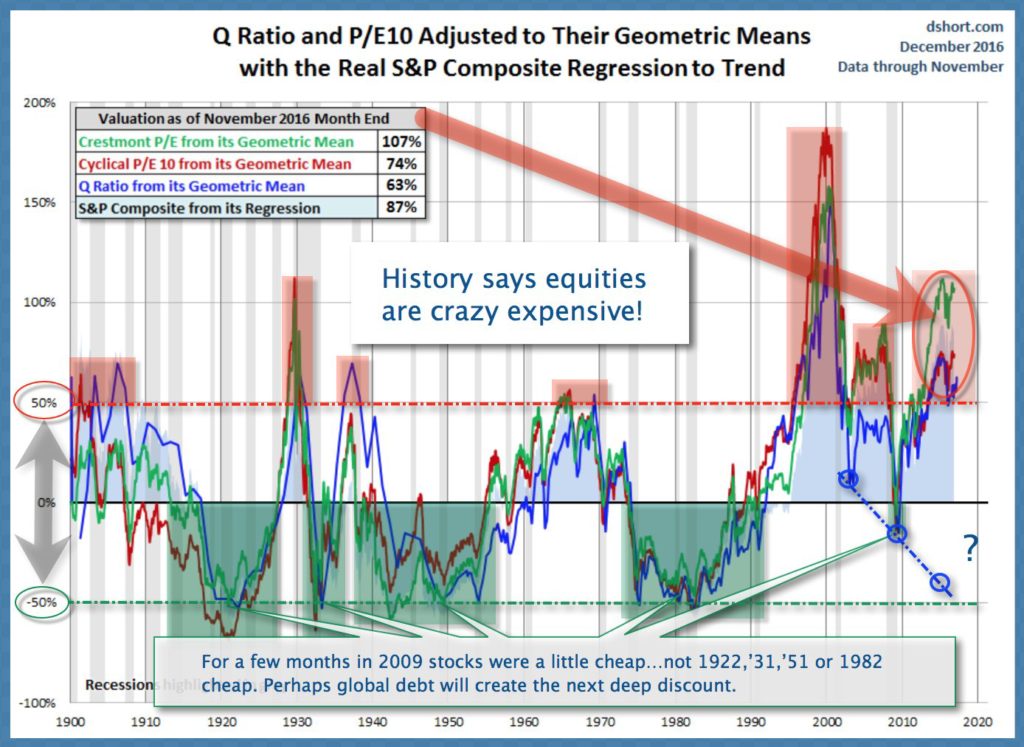

The ‘Trumplosion’ in US stocks since the US election has been truly death-defying, with equity valuations now pushed to the most extreme, dangerous and historically fleeting levels ever (see pink areas below since 1900).

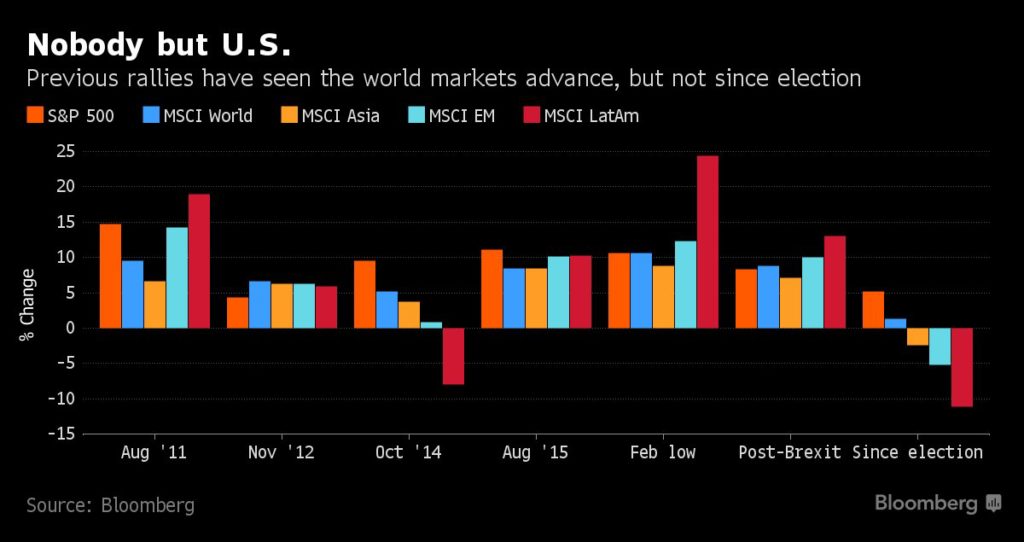

The party has only been in North America though–led by Trump-friendly expectations for financials and energy. We should note that what’s great for oil and financial profits are generally at the expense of everything else–both sectors are taxes on growth, not drivers of it. Meanwhile, other key global stock markets have all declined since November 8 (chart).

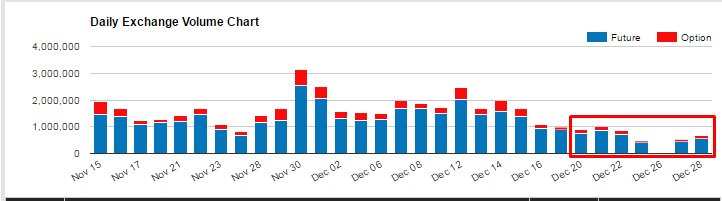

Of course, during the holidays, less participants mean rapid-fire trading algos have greater price effect than usual. And as shown here, the daily volume of transactions since November has been low as usual.

Starting with record and rising debt, still-crisis low interest rates and slow growth, cyclical lows in unemployment along with cyclical highs in investor confidence and asset valuations, 2017 is coming in on great expectations.–to say the least. When Obama took office in 2009, the consensus feared the world might be ending. Today with ‘The Donald’ supremely confident in his own powers and ability as business leader of the free world, what could possibly go wrong?