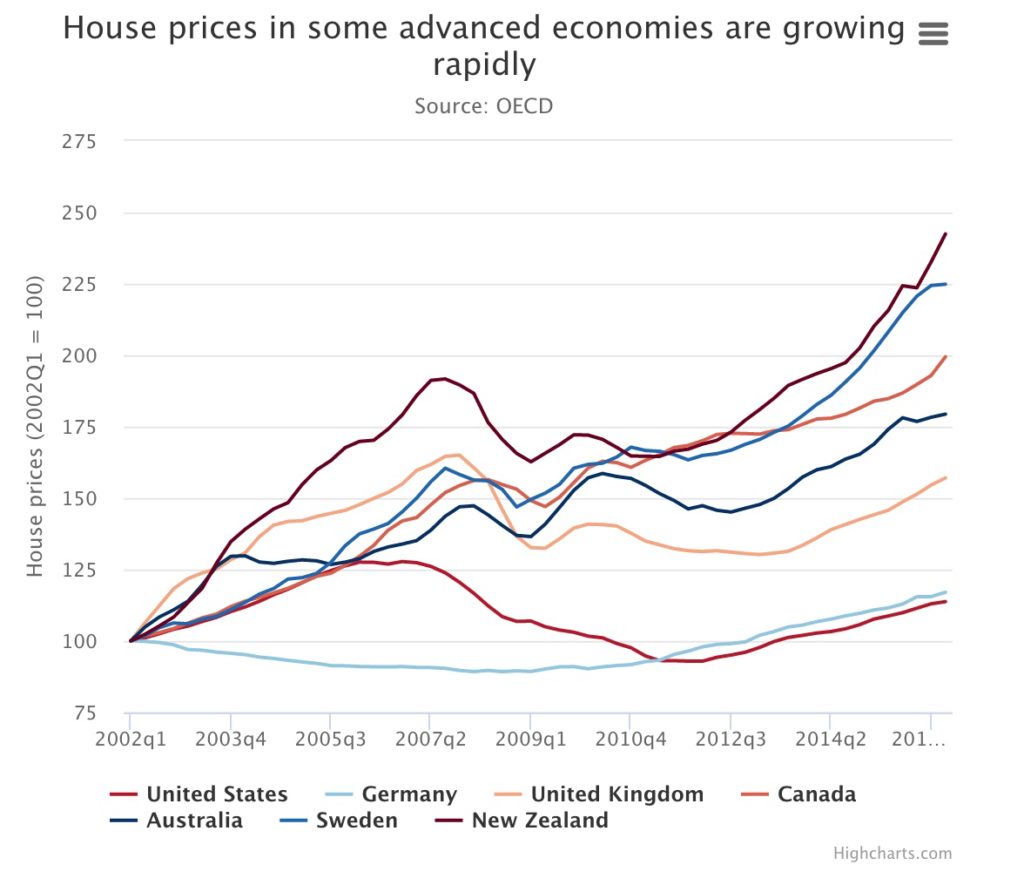

A new report from the OECD is sounding the alarm on ‘dangerous’ conditions in several global property markets: especially New Zealand, Sweeden, Canada, Australia and the UK. While bad for ‘investors’ and the highly levered buyers who have been driving prices beyond reasonable levels, the report also notes that lower prices will eventually be better for families looking to form households. First however, a plunge in prices will destabilize the economies who have become overly dependent on rising property values. See Fears of a ‘massive’ global property price fall amid ‘dangerous’ conditions and market-slowdown:

Property prices have climbed to dangerous levels in several advanced economies, raising the risk of massive price falls if markets overheat, according to the Organisation for Economic Co-operation and Development (OECD).

Catherine Mann, the OECD’s chief economist, said the think-tank was monitoring “vulnerabilities in asset markets” closely amid predictions of higher inflation and the prospect of diverging monetary policies next year.

Ms Mann said a “number of countries”, including  Canada and Sweden, had “very high” commercial and residential property prices that were “not consistent with a stable real estate market”…

Canada and Sweden, had “very high” commercial and residential property prices that were “not consistent with a stable real estate market”…

While many of these countries have already introduced policies designed to reduce financial stability risks, including forcing buyers to find larger deposits and imposing borrowing limits, Ms Mann suggested that a house price crash would also reduce household spending.”