Trump’s policies will help the U.S. economy, but they won’t be enough to save stocks long term, Faber said. Here is a direct video link.

Here we can see (as mentioned by Faber) that under the much celebrated headline advances, the ratio of new 52 week highs to new lows for stocks in the S&P 500 has been rolling over since 2014. Not bullish.

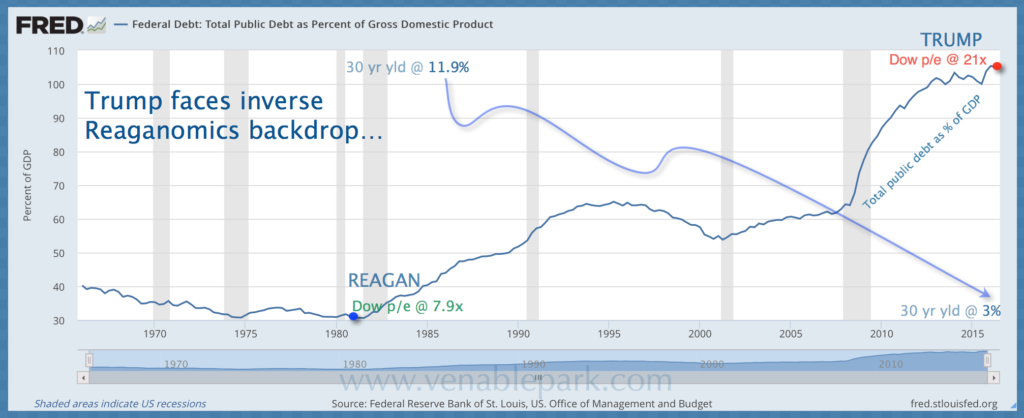

The “higher diving” board for risk markets from here is built on record debt, corporate profit margins that peaked in 2014, and historic highs in asset valuations as Trump takes office (the opposite of when Reagan took power as shown below).

In the end, we all must devise strategies to navigate the cycles we inherit. Oblivious, high leverage and dumb luck can work well during secular bull cycles, at least for a while. But during secular bear periods like today, humility, realism and risk management rules are key to survival over the full market cycle. Like driving fast on black ice, hubris and overconfidence tend to be suicidal in these conditions.