America should brace for a final blow-off surge in stock markets akin to the last phase of the dotcom boom or the “Gatsby” years of the Roaring Twenties, followed by a cathartic crash and day of moral judgment, according to a Nobel prize-winning economist. See: Donald Trump ‘could send America into the Next Great Crash’ warns Nobel laureate Robert Shiller.

Well catharsis is long overdue, but come now Robert, we can’t give Donald all the credit, he hasn’t even taken the seat yet!

The next great crash has been earned by a lot of reckless and fraudulent help from a whole bunch of people over the past 20 years. No one person can be blamed for this mess. One thing we can know for sure, ‘The Donald’ will definitely not be claiming credit for this one in the end.

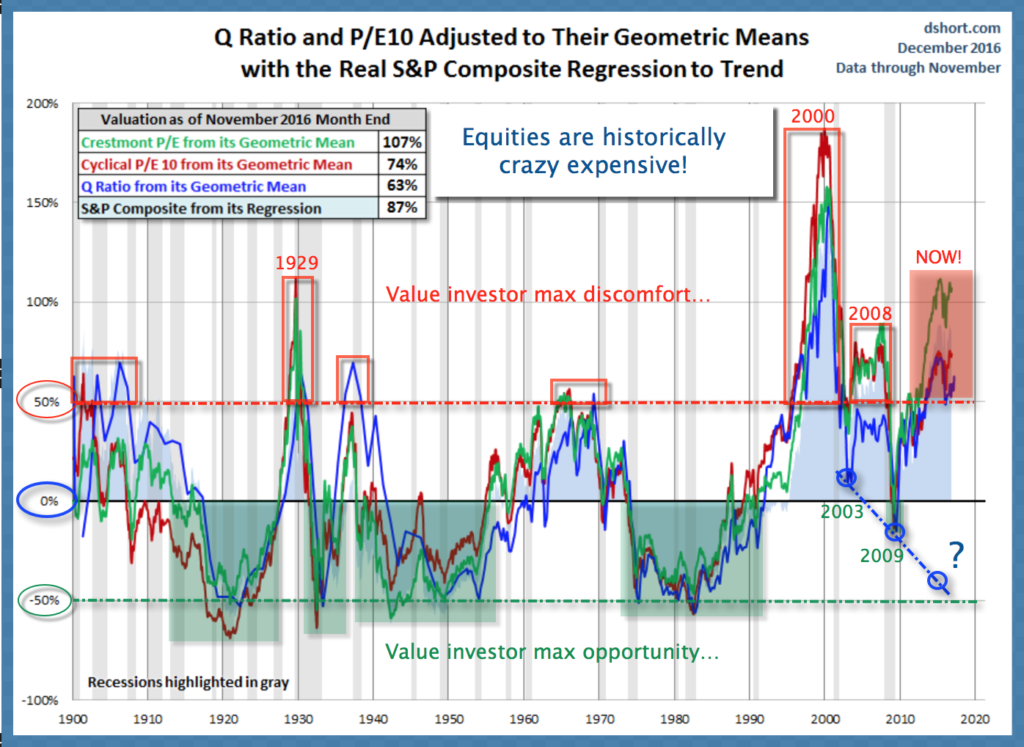

…The Cape Shiller P/E index measures the average earnings of S&P 500 equities over 10 years in real terms, and is closely watched by investors as a gauge of underlying value. It is trading at roughly 25. This is the highest level in over 130 years, excluding the two anomalies of the late 1990s and 1920s.

Here is the chart of Shiller’s cyclical PE 10 (in red) along with other historically reliable indicators (Crestmont P/E, Q Ratio and composite from regression), showing today’s over-valuations compared with the infamous 1929, 2000 and 2008 pre-crash peaks.

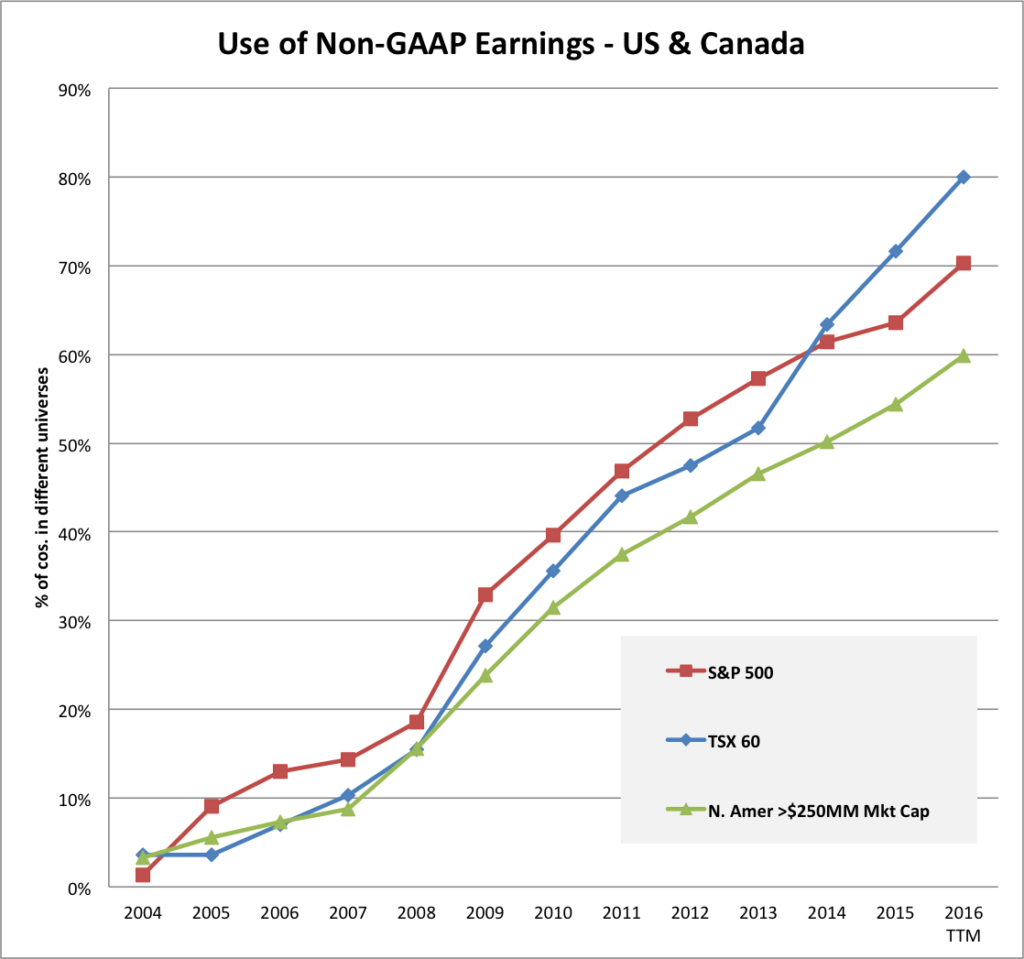

Not only are large-cap stock prices crazy high, mid-cap companies (market caps of 300m to 2b) are even worse–the Russell 2000 is trading at some 237x net income. Still given the trend of companies reporting Non-GAAP (inflated, massaged, orchestrated) earnings the past few years (70% of S&P and 80% of TSX companies, as charted below), today’s valuation calculations are likely understating the madness.