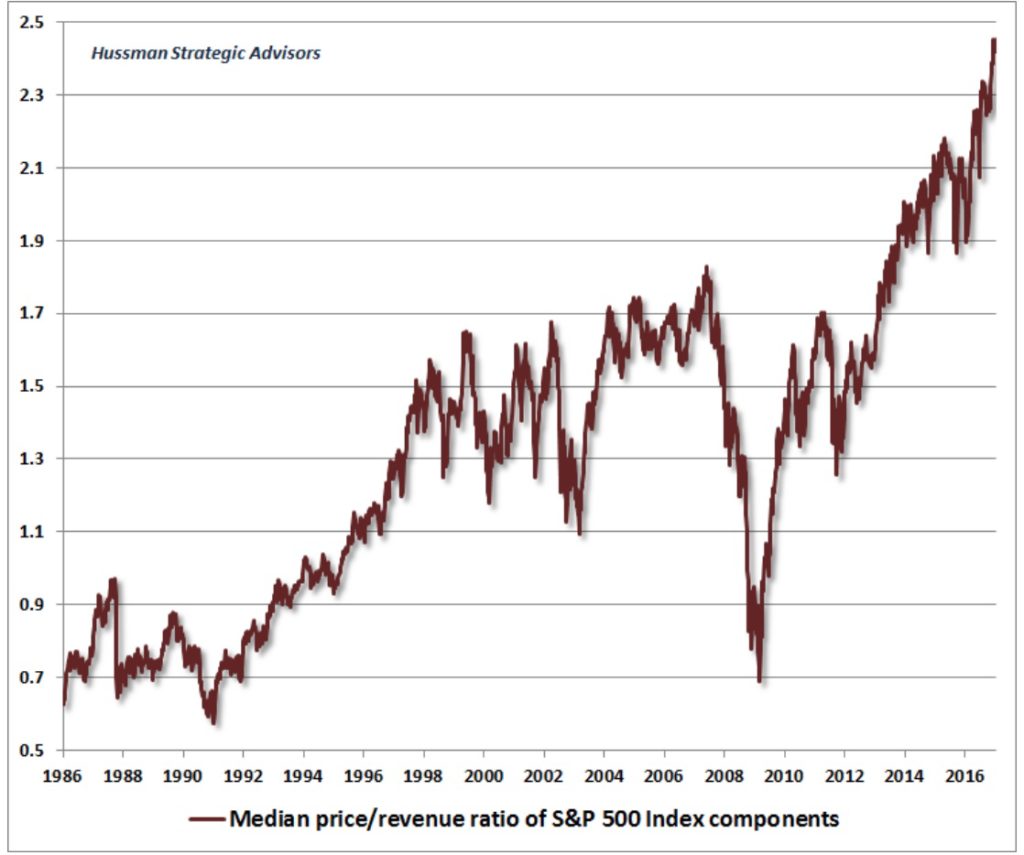

S&P 500 price to revenue ratio charted here since 1986, much worse than the 2000 market bubble: today at 2.45 versus historic average of 1. A retreat to just 1.3 would take stock prices down by 50%. (See: On Governance.)

“The problem our nation faces is a serious one. We have now paired a massive speculative bubble with an errant pin that has every prospect of creating disruption. A steep financial retreat was already baked in the cake prior to the election. My concern is that having reached this precipice, there are few policies that have the capacity to make the consequences substantially better, but many that could make the outcomes substantially worse.” –John Hussman, January 30, 2017

“The problem our nation faces is a serious one. We have now paired a massive speculative bubble with an errant pin that has every prospect of creating disruption. A steep financial retreat was already baked in the cake prior to the election. My concern is that having reached this precipice, there are few policies that have the capacity to make the consequences substantially better, but many that could make the outcomes substantially worse.” –John Hussman, January 30, 2017