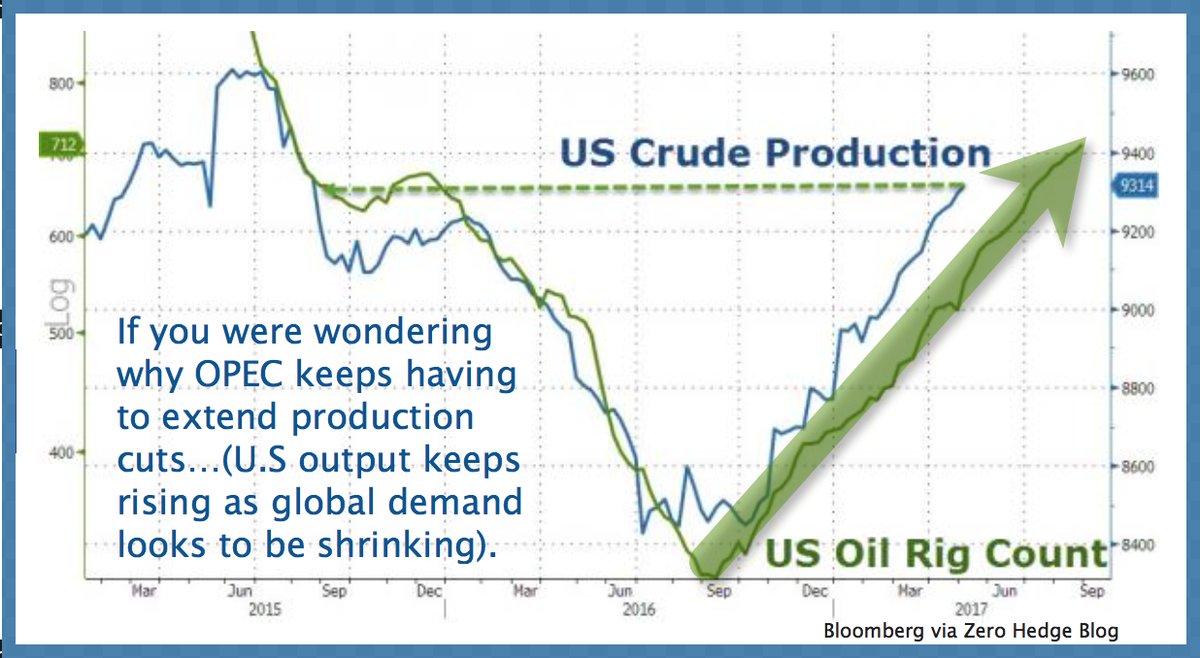

Extending the OPEC plus Russia cuts should help bring commercial petroleum inventories down and boost crude prices by a few dollars a barrel in the short-term. But in the bigger picture: OPEC (Canada and other dependent exporters) are likely to lose revenue while the US becomes the world’s top oil producer. All the while, slower global growth, increasing efficiency and booming alternative energies will continue to erode the world’s oil demand. Less demand and more supply lead to lower prices and a transformation of the power structure that has dominated the world for the past 60+ years. Messy but necessary for evolution. See: The real winner from oil supply cuts:

The ultimate free-rider on Saudi sacrifice is nimble U.S. shale. So much capital is now being deployed that the U.S. may become the world’s top oil producer by 2018, topping Russia and Saudi Arabia.