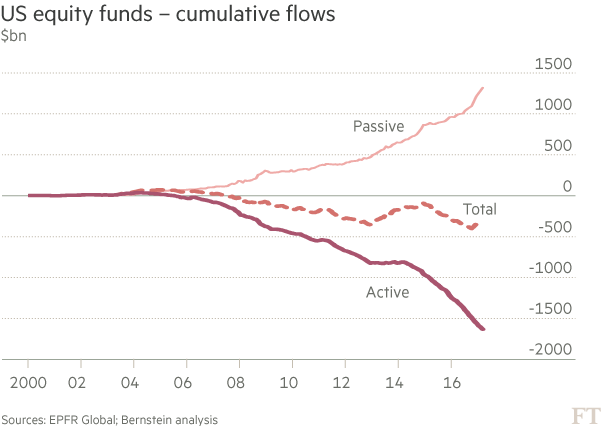

As trillions in quantitative easing flowed into financial markets the past 7 years, volatility has fallen back to historic lows and valuations to historic highs. In the process, as shown in this chart, many people have increasingly moved savings into passive ETFs and indices as well as robo-advisor platforms, that offer limited human involvement.

process, as shown in this chart, many people have increasingly moved savings into passive ETFs and indices as well as robo-advisor platforms, that offer limited human involvement.

After all, if most ‘active’ money managers and investment funds are long-always, buy and hold allocators, who never reduce risk exposure, or hold cash beyond 3 or 4%, then what diversification, what alpha, what value-added? Sounds like a bad trade for the person supplying the capital. If our money is going to rise and fall in lock step with the market cycle, then paying management fees will only reduce our net gains and increase net loses. No thanks.

This discussion however, misses the most important determinant of net capital progress in our life time. It’s not stock picking, or index increases that define investment returns over full market cycles, but rather what net losses we experience in the process. This is Harry Markowitz 101. In his seminal 1952 paper entitled “Portfolio Selection” (widely misinterpreted since), Markowitz reminds that it’s not holding lots of different securities that defines portfolio performance, but rather avoiding assets that rise and fall at the same time:

“Similarly in trying to make variance small it is not enough to invest in many securities. It is necessary to avoid investing in securities with high covariances among themselves.”

This is much easier said than done today. It is precisely the herd of international banks, ‘long always’ funds, indices and managers, that have made global markets highly correlated–where returns are defined little by which country or sector, or which stocks or corporate bonds one holds–but rather to what extent these assets fall in value during our holding period.

Markowitz defined risk as the likelihood that our actual returns will fall short of our expected returns over time. This causes us to under-save, over-spend, and mismatch assets with our liabilities during our working years. The trillions in capital deficits that have compounded in pension, trust and foundation funds all over the world, through big market ups, and downs, the last 17 years, confirms this thesis.

As I have noted many times, business and market cycles are driven by the ebb and flow of credit and human behavior. Hence cash flows–both business and employment–are always inherently cyclical, while debt payments and life expenses are constant. Central banks, politicians, managers and individuals try to deny or ignore this iron-clad law with repeatedly disastrous results each time.

Investment allocations with the least capital risk and best reward prospects are always made near cycle lows, when the masses are liquidating in panic and necessity. In a financial world of highly correlated assets, achieving meaningful risk management requires that we do the opposite of the masses: pay down debt and build up cash during the mid-to-late expansion cycle, so that we have buying power when others are dumping assets in the downturn and liquidity crunch that follows.

It takes discipline, patience and the strength to move counter to the herd, but the alternative is devastating.

Anyone can be an indiscriminate buyer, all on their own. Investment products, funds, stock pickers, managers or robo-advisors–that charge us to constantly expose our capital to market risk are a bad bargain. Their fee will only decrease our gains and increase our losses–while we carry all the risk.

The only thing that can add value over a full market cycle is a manager or rule set that helps us to buy low, sell higher, and wait on the sidelines for the next reset–however long that takes. Ironically, even though this is the only way to make and retain net returns over time, few attempt to do so, because it requires historical insight, emotional intelligence and personal discipline– not just in the managers, but the clients too.

Here is a low risk forecast: the preference for passive investment products, platforms and long-always managers since 2009, with end in the usual panicked selling and tears during the next bear market. Then, only those who are out favor and ‘hedged’ against market risk now, will be proven worth their fee and back in demand once more.