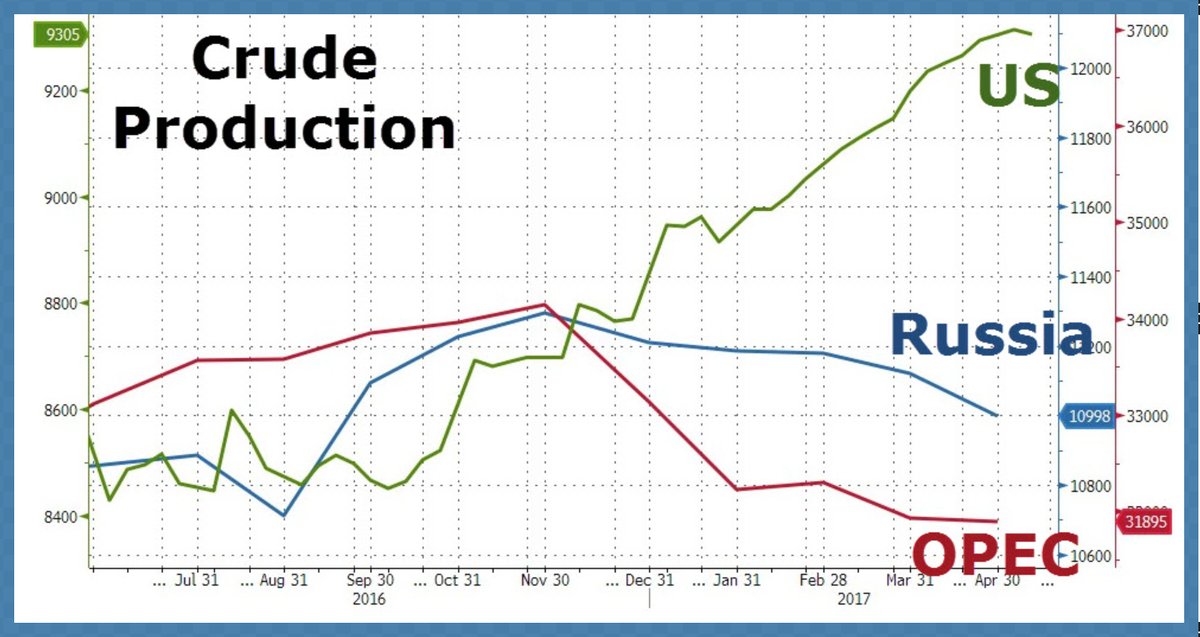

Oil markets are selling-the-news of an OPEC cut extension agreement this morning. Try as they might to tighten supply, and pump up prices for their upcoming Aramco IPO, OPEC is facing structural headwinds: a world awash in supply and weakening demand thanks to new alternative energy technologies and greater efficiency. The more they agree to hold down output, the more others pump. This chart offers a glimpse of just the US production response to OPEC and Russian cuts since last November. Not to mention of course, all the other non-OPEC global producers like China, Canada, Mexico, Norway, Brazil and many more. (chart source Bloomberg via zerohedge).

In a world of aging boomers, stagnate growth, high debt and excess capacity, everyone is increasingly eager to raise cash through exports–not just of crude, but of pretty much everything. The result is structural and stubborn deflation in the price of goods (accelerated by weakening export currencies and racing technological advancement), falling corporate sales/revenues, weak wage growth and lower tax receipts.

In all these circumstances, we should expect to see a mounting global urge to raise liquidity by cashing out of low and negative yielding, long duration assets like inventory stockpiles, commodities, equities, real estate and the riskiest bonds. This chart of the commodities index (CRB) and the US 10-year treasury yield (TXN) confirms the trend of slowing demand and deflation since the global growth rate hit a cyclical and secular peak in 2006.

In all these circumstances, we should expect to see a mounting global urge to raise liquidity by cashing out of low and negative yielding, long duration assets like inventory stockpiles, commodities, equities, real estate and the riskiest bonds. This chart of the commodities index (CRB) and the US 10-year treasury yield (TXN) confirms the trend of slowing demand and deflation since the global growth rate hit a cyclical and secular peak in 2006.

The verdict is clear: central banks and product sellers like OPEC–and the financial sales force–can forecast and talk up higher prices everyday, but they can’t sustain them all on their own. Macro trends are in charge here, and they are just not buying the bull.