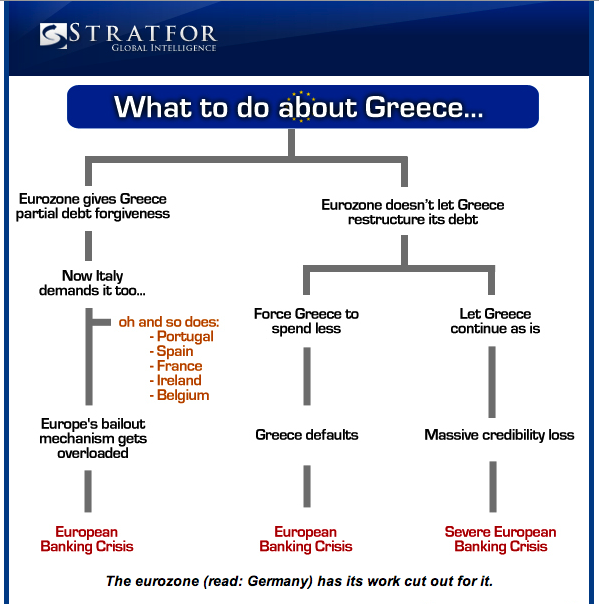

There is no painless escape from the European banking crisis. This chart is a good summary of possible paths from Stratfor Global Intelligence:

Short cuts in favour of speculation, transaction commissions and weak regulation have degraded the integrity of our financial system: See WSJ: London’s FTSE 100: from blue chip to fool’s gold:

Something has gone wrong with the FTSE 100. The index of the largest 100 U.K.-listed companies used to be a byword for blue-chip respectability. But that is no longer the case: Bankers are exploiting loopholes to fast-track emerging-market businesses into the index, side-stepping the scrutiny of an IPO. That is bad news for investors in funds benchmarked against the index who may be being exposed to far greater risk than they realize.

(Ever notice how many ads on business news these days are promoting resource and gold companies? Remind you of the tech company ads in the Tech bubble in 2000 or loan ads at the consumer credit bubble peak in 2006?)

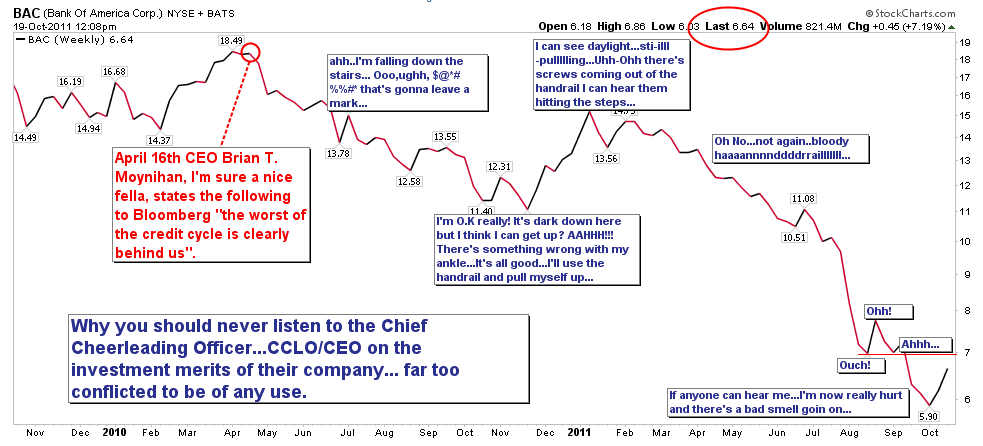

And a useful reminder from Cory Venable on why the assurances of CEO’s can be lethal as shown in his chart of Bank Of America shares over the past year.