CNBC anchor Steve Sedgwick has penned a refreshingly candid commentary on the spending and debt abuse plaguing his native Britain today. See Spend now and pay never: a very British obsession.

My generation, the forty-somethings that should know better are just as bad. Most people I know drive a brand new or nearly new car. They don’t own it, they just drive it. Nobody bothers saving any more, they just prefer to pay an extra 7 percent on a personal contract purchase, which means they pay an auto company, or an auto finance company, 7 percent for the privilege of borrowing a car they most likely will never pay off in full.

Saving is apparently pointless with pathetic QE-inspired interest rates. According to the ONS, U.K. savings fell to 1.7 percent in the first quarter of 2017. The Germans, incidentally, still save at around 10 percent despite negative interest rates over at the ECB.

This is the time bomb and everyone knows is ticking even if they are too busy in the pubs and restaurants, the car dealerships and the queue for the new iPhone to acknowledge it. With UK inflation providing a potential uptick in rates at some stage how long before our “have it now and pay for it never” attitude comes home to haunt?

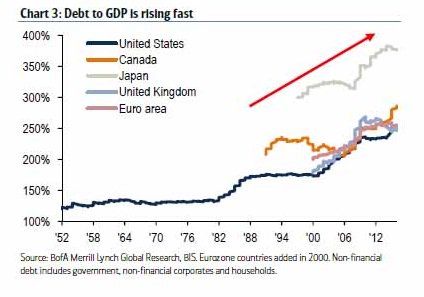

I would add that similar financially destructive behaviors are obvious all over Canada today as well. Actually, in the race for highest debt to GDP, Canada (in 0range) is beating the UK and lagging only Japan (light grey), as shown here.

This is no free spending spree.

This is no free spending spree.

We will pay in the end, through rising financial instability and social problems, capital deficits, falling cash flows, defaults, bankruptcies, write offs, more job losses and of course, higher taxes.