It’s a harsh reality of human behavior and capital markets: when assets are at deep discount and value and yields the best, would be ‘buy and holders’ who bought high have lost their shirt and are running for the exits. But when assets are obscenely valued with pitiful yields and years of zero and negative returns baked in, optimism is at cycle highs and those who ran at the lows, are finally rushing to put in every last bit of cash and margin debt they can borrow.

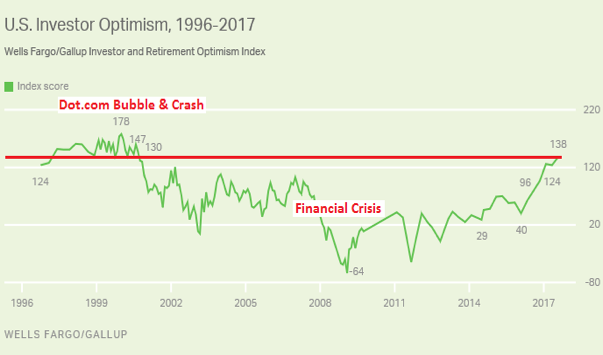

For those retired, a recent Gallup Poll finds stock market optimism at the highest since the market peak in 2000.

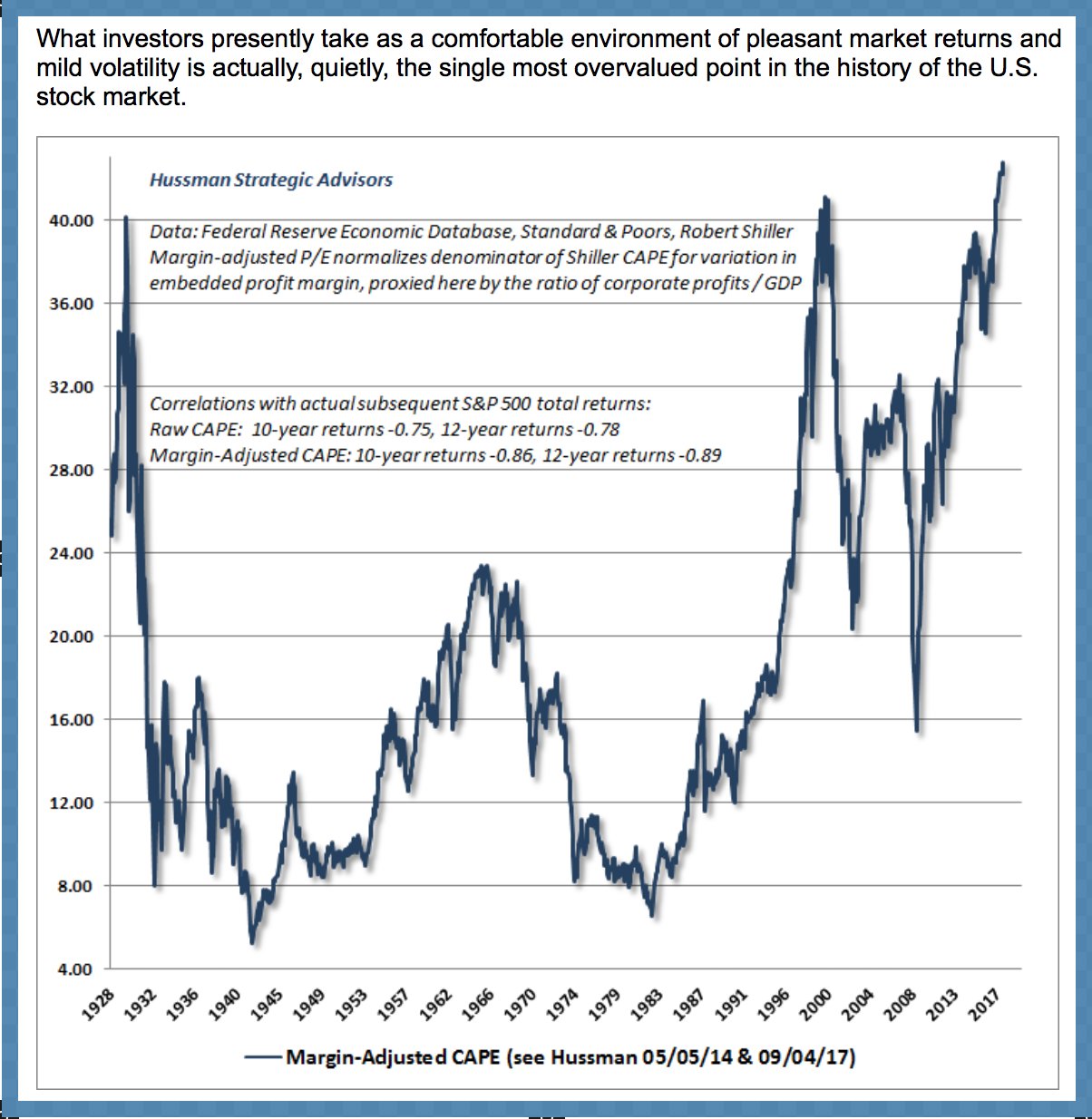

Just as US stock valuations have officially eclipsed their 2000 peak and are now priced for 12 years of negative returns from here. See Bubble Mindset and an excerpt explaining below the chart.

“the chart …shows my variant of Robert Shiller’s cyclically-adjusted P/E (CAPE), which can be substantially improved, as measured by its correlation with actual subsequent market returns, by adjusting the multiple for its embedded profit margin. I originally used the ratio of Shiller earnings (the denominator of the Shiller P/E) to S&P 500 revenues as a measure of the embedded margin. Since freely available data on S&P 500 revenues is limited, the embedded margin is proxied here by the ratio of corporate profits to GDP (allowing the measure to be calculated back to the 1920’s h/t Michael Ritger).

Specifically, the CAPE (calculated here as the ratio of the S&P 500 to the 10-year smoothing of inflation-adjusted earnings) is multiplied at each point in time by a factor equal to the 10-year smoothing of corporate after-tax profits to GDP, divided by the historical norm of 5.4%. The resulting measure is similar to the S&P 500 price/revenue multiple, the ratio of market capitalization to corporate gross value-added, and other measures that share a correlation near 90% or higher with actual subsequent 10-12 year S&P 500 total returns in market cycles across history.

What investors presently take as a comfortable environment of pleasant market returns and mild volatility is actually, quietly, the single most overvalued point in the history of the U.S. stock market.”