Times are pretty desperate. Investor sentiment is very low. Consumer sentiment and spending have fallen off a cliff. The VIX “Volatility Index” investor fear gauge spiked to 70 Friday. This same indicator was below 10 for much of 2005 to 2007 as the world slumbered in apathy and oblivion. Sadly, idiots fiddled while Rome burned, again. Now that financial pain has struck, people are wide-awake in fear and anxiety.

I attended a fund-raising Gala last night. The attendees were more affluent than the average Canadian and most were commenting with concern about the shocking decline in the economy this year. Since so few people are ever prepared for the downturns, most have been taken unawares.

Net worth is being hit across the board with simultaneous drops in business revenues, real estate, and investment portfolios. People have the feeling that they are literally under siege, they are traumatized and weakened by it. None of this is unusual or unprecedented. These are the common symptoms of every economic downturn. The only aggravating feature this time is that the downturn is across all asset-types and business, as de-levering is taking place all around the world and at once.

The last times this type of broad-based downturn hit was 1973-74 and 1980-82. Few business people or investors that are experiencing this downturn had much to lose during those previous down cycles that long ago. That is why many today feel like present conditions are unprecedented. Most have never seen anything like this recession. But this too shall pass.

Warren Buffett tried to reassure Americans this week in an op-ed article entitled: “Buy American. I am.”:

“The financial world is a mess, both in the United States and abroad. Its problems moreover have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise business activity will falter and headlines will continue to be scary. So…”[and here is the money quote the investment sales crowd will jump on] “I've been buying American stocks.”

Far and wide, buy always investment types will be grabbing Buffett's quote and screaming it from the roof tops in an effort to suave the wounds of those that have bought “buy and hold advice” throughout the past few years to their financial detriment. But here is the part of Buffett's quote that is most crucial of all and yet, will be widely over-looked:

“This is my personal account I'm talking about, in which I previously owned nothing but United States government bonds.”

Buffett is buying now because prices have been pummeled. And because his net worth has not. He has had his entire personal account in cash-like equivalents throughout this downturn. He is in a position of strength now, because he has cash and because he has protected himself from a savage bear market over the past year.

The virtue of cash and is that you then have a position of strength when others are weak and desperate.

This is the point that I have been trying to make for the past couple of years. If you never leave the party of a bull market, you never get to come back and clean up later. If you never see the need to build up cash and pay down leverage in your business, you will never be prepared for an economic downturn.

It is also worth noting that unlike 99.9% of the world, Buffett has no debt, incredible income and billions in savings. And even with his incredible resources he saw the need to go to TBills and defend his personal account from the market downturn. Because of this, now he is ready and able to buy.

Having been out of equities this past year, Buffett [and our clients] are now in a position of strength as we watch for our re-entry points. Remember this the next time someone try’s to tell you that you can't avoid down markets or that Buffett never sells and always holds. It is simply not true.

Follow

____________________________

Cory’s Chart Corner

Load MoreHeadline chasing algos need to do deeper dives...

h/t @hussmanjp John P. Hussman, Ph.D. @hussmanjp

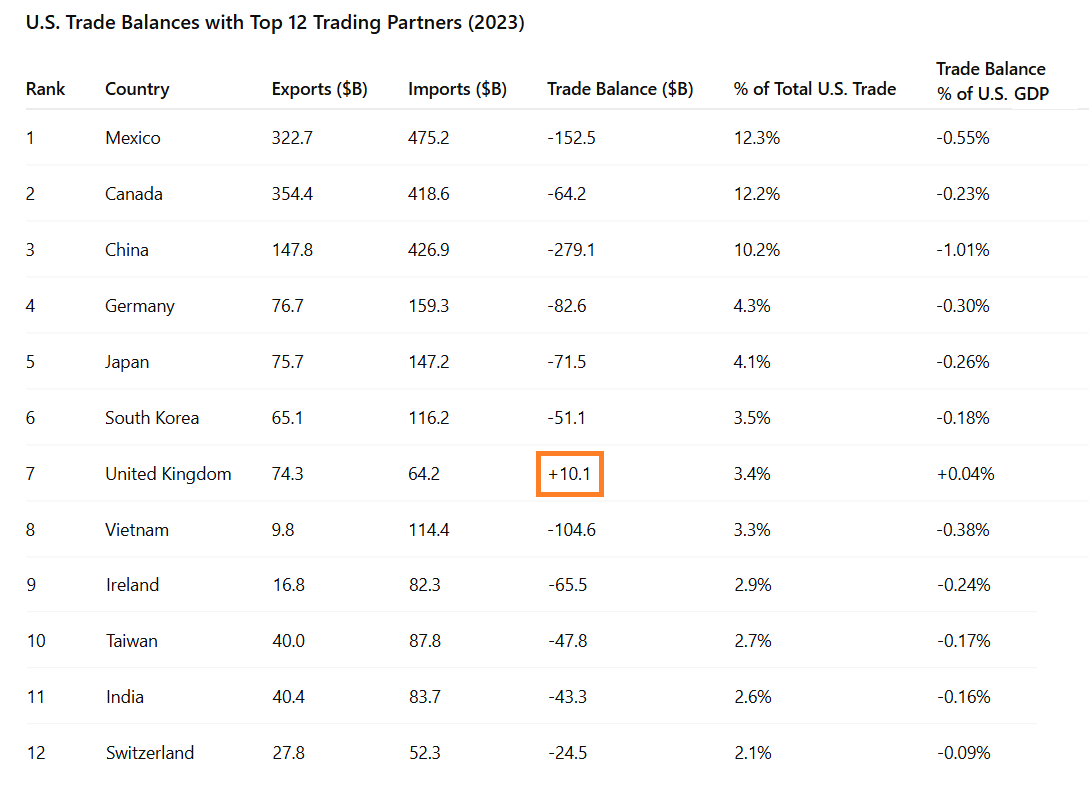

John P. Hussman, Ph.D. @hussmanjpy'all realize the UK is only about 3% of U.S. trade, the U.S. already runs a surplus there, and the 10% U.S. tariffs will stay, right?

keep in mind that studies indicate U.S. consumers shoulder the majority of tariff incidence, with minor incidence to foreign countries____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In

I believe I not too distant future we might see a dynamic shift in how the west does business. By now it must have occurred to the governments and corporations that exporting jobs to other parts of the world weakens domestic economies. It must have occurred the labour unions that forcing unreasonably demanding collective “agreements” on corporations drives good jobs to other parts of the world, where it is still understood that there is a direct correlation between salary and education. Many of us seem to have forgotten that our qualifications determine the lifestyle we can afford. The sense of entitlement is likely as responsible for their current financial difficulties as any bad advice or marketing we may have been subjected to; it is a matter of common sense that debt leads to trouble.

Assuming that the appropriate lessons are learned from the current crisis and we emerge from this fiasco humbled, but wiser, Warren Buffet is probably right. American industry might just experience a renaissance. Question remains, will we Canadians also learn from this and finally elect to invest in a viable, domestic industrial base or will we continue to live off of what we harvest from the ground or dig up from underneath it. Should the later persist we will continue to prosper, or not, at the whim of the rest of the world.

Marcus

What pains me is the buy and hold advise of so many Financial Advisers. I have read article after article about how FA are trying to calm their clients about holding on through this downward trend. The same advice is followed with buying now and taking out loans to purchase at these “opportunity of a lifetime” prices. However, they are pushing Mutual Funds not stocks. Warren Buffett is buying stocks, not Mutual Funds. It is the Mutual Fund industry that has been screwing Canadians for years. It is this industry that is fueled by hundreds of Financial Advisers who are really just Financial Product Salespersons. They are armed with all kinds of rhetoric to fend of your questions about index funds and selling on the highs.

Mutual Funds do not want you to sell which is why they charge you a percentage for taking money out during a 6-8 year period. One FA told me that you don't have to have a sell strategy since the Fund manager is selling on the highs. If so, why have so many mutual funds plummeted. Why are so many Canadians opening up those monthly statements only to see thousands less than the previous month.

Your FA does not want to sell you Index Funds, because he will make nothing from them. One FA said that Index Funds are like throwing your money to the wind. Utter Nonsense. Times are tough for the FA industry so getting those to take out loans only ensures they have income in the future.

If the average investor had a sell strategy and sold on the highs, they would be armed with cash. Cash they could now use to take advantage of this “opportunity of a life time.”

If you are reading Danielle's Blog then you are further ahead of most Canadians as you are learning what your FA does not want you to know. You cannot be a successful investor with out taking some responsibility to educate yourself. For those who just want to give their money to a FA and forget about it. I would suggest you invest in Bonds.

Jeff

Good post. These financial “advisers” need to be exposed. I too have heard story after story about how they have little regard for their clients' best interests, but only after their own fees.

Even the term “financial adviser” is dangerous and misleading. These people are nothing more than salesmen.