For decades, the financial industry has insisted that it is a crucial engine to economic prosperity by increasing access to credit and ‘investment’ opportunities. Widespread acceptance of this narrative by governments and individuals alike, has led to decades of increasingly preferential treatment and deference to the financial sector and their requests. The more enriched the sector has become, the more influence they have been able to purchase in setting–in many cases literally drafting– public policy, rules and regulations that serve the pecuniary interests of finance first.

Since the 2008 financial crisis and the madness an d mayhem that has followed since, an increasing chorus of people with clarity and courage have been pushing back on financial propaganda (some of us were sounding the alarm before the 2008 blow up!) A steady stream of studies since have proven unequivocally, that while small amounts of credit can jump-start economic progress in helping to get small business initiatives up and running, consumer credit actually has a negative effect in the medium to long-term, hollowing out growth and stability for years to come.

d mayhem that has followed since, an increasing chorus of people with clarity and courage have been pushing back on financial propaganda (some of us were sounding the alarm before the 2008 blow up!) A steady stream of studies since have proven unequivocally, that while small amounts of credit can jump-start economic progress in helping to get small business initiatives up and running, consumer credit actually has a negative effect in the medium to long-term, hollowing out growth and stability for years to come.

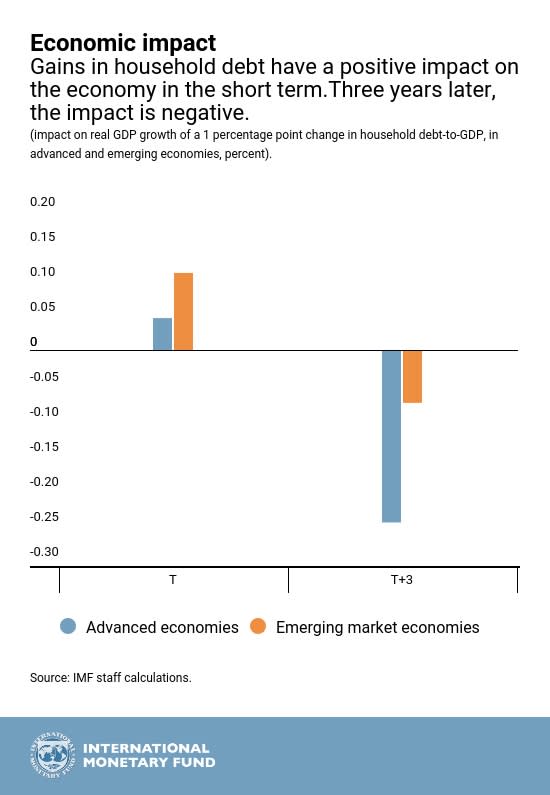

The evidence is so overwhelming, and the cumulative negatives for the future so ominous from present debt levels, that even conventional organizations and institutions are sounding the alarm. A recent report from the IMF establishes statistically that while a rise in household debt can boost economic growth in the very short run, it makes growth three to five years down the line lower than it would otherwise have been, even as it substantially increases the risk of a banking crisis. The IMF’s chart is on the left.

Today, many countries, including my home Canada, have the highest household debt levels ever in history, and much worse than at the last debt bubble peak in 2007. See: Most (financial) accidents happen in the home:

The IMF itself has previously established that financial development can improve a country’s prosperity in the early stage — a modern economy needs financial services — but when it reaches a certain size, any further development, on average, destroys wealth. But importantly, not all finance is created alike. The OECD, too, has shown the general finding that beyond a certain point, more finance is economically harmful. But when the researchers separated different forms of finance, they found something fascinating and important: the worst effects come from banking finance and from credit that is extended to households.

Now consider that in our cross-selling-frenzied, financial sales-conglomerate-dominated world, credit pushers are also ‘advising’ (indeed running governments and central banks), as well as institutions and households on how best to ‘build wealth’ and prosperity, while also sponsoring and commissioning much of the academic research and ‘experts’ in this area.

There is no wonder the world has gone so far off a sustainable track, and is poised for the next and potentially worst financial blow up yet. It requires great personal discipline, insight and understanding to resist the presently ubiquitous offering of financially destructive choices. Sadly, most don’t understand this yet, and will be victimized once more. And in the end, we will all pay for that.