As the stock market parties like it’s early 2000, a historically reliable indicator of economic weakness, the yield curve, continues to raise alarm in North America. The spread between 2 and 10 -year US Treasury yields reached a new cycle low of .75 this week, and in Canada .51.

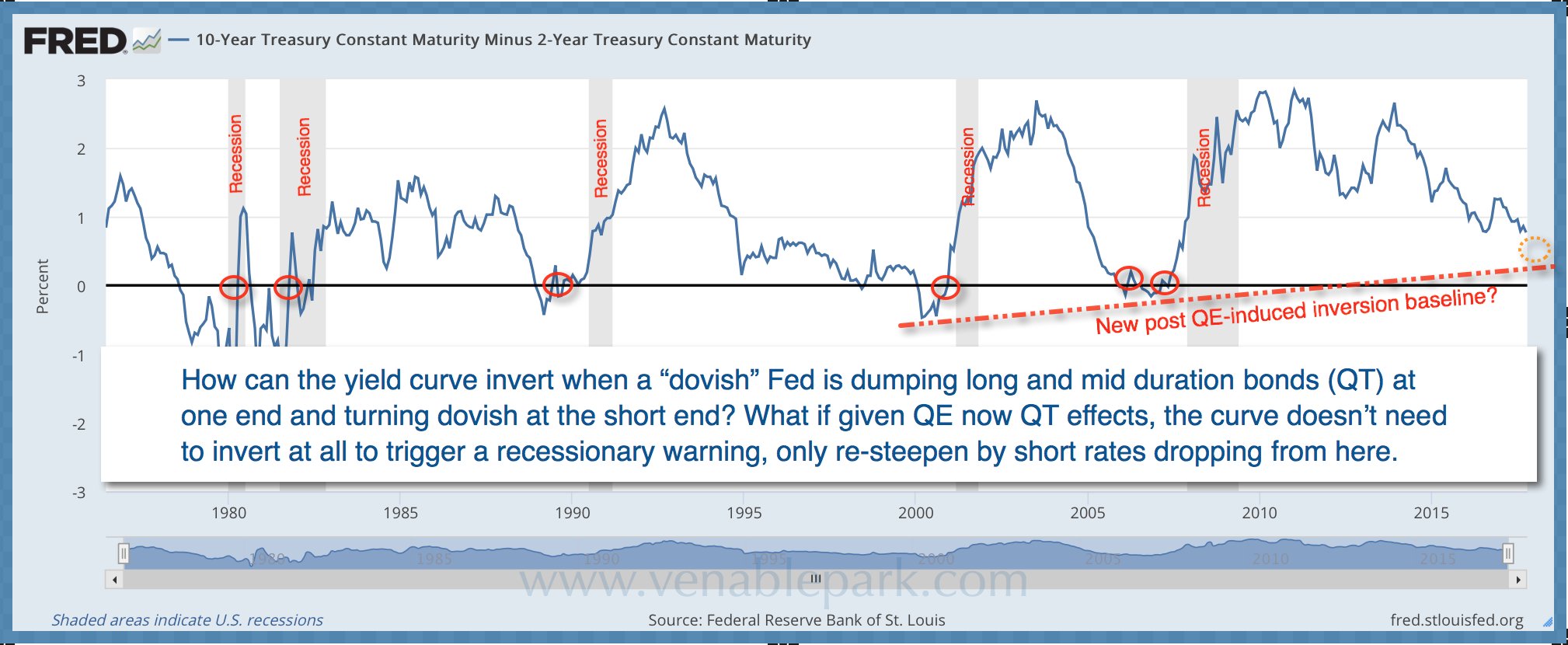

As show below in my partner Cory Venable’s chart since 1975, when these spreads reach zero, a recession is underway or close at hand.

In the present extraordinary cycle though, with central banks so aggressively influencing both ultra-low short-term yields, as well as longer term rates with QT (quantitative tapering), the question is whether a classic inversion of the curve will happen this time, or whether something close to zero may be close enough (for hand grenades).

One thing for sure, the timer is running down on this expansion cycle, and it’s never a question of if, but only when, the next recession and bear market arrives. They’re overdue. Who’s prepared?