Exchange Traded Funds (ETFs), mutual funds or indices are only a marketing wrapper or package around a group of individual securities. Reassuring names aside, their investment prospects can only be as good as the individual constituents within– defined by their market price versus earnings, sales, assets, cash flow and future prospects–and the macro cycles at hand.

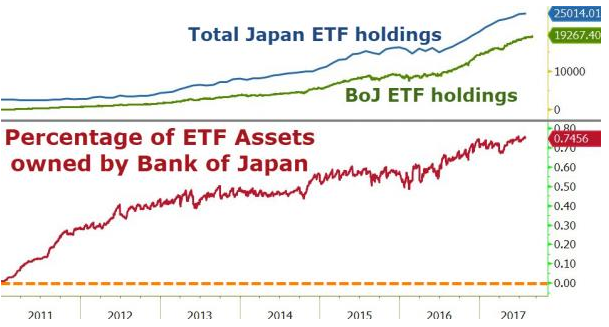

Worse this time, this market cycle has seen trillions in indiscriminate fund flows driven by central banks into ‘passive’ security packages all around the world. Just one example, the QE-world-leader the Bank of Japan, now personally owns some 75% of all the ETFs in the country, as shown in this graph courtesy of zerohedge.com. This is not about investing.

Mindless global fund flows have become so garish and irrational this cycle that even people like Robert Shiller–who partnered with index producer Standard and Poor’s over the past decade- are having to admit the allocations make zero sense:

Mindless global fund flows have become so garish and irrational this cycle that even people like Robert Shiller–who partnered with index producer Standard and Poor’s over the past decade- are having to admit the allocations make zero sense:

“The strength of this country was built on people who watched individual companies. They had opinions about them. All this talk of indexes, it’s a little bit diluting of our intellect. It becomes more of a game,” Shiller said Monday on CNBC’s “Trading Nation.” “It’s a chaotic system.” See: Robert Shiller on what worries him about passive investing.

The idea that buying and holding packages of hideously over-valued securities is sound investing has never been true. It has however, been the marketing machine of choice in the fee-gorging financial sector.

Perhaps buyers prefer not to contemplate the worry and risk of over-valued asset markets and prefer anesthetizing marketing wrappers that gloss over the unpleasantness of rot within. It will not protect them from it though. Out of mind remains real and present danger.