Today the wealthiest 1% of the global population has more more than at any time in the last 50 years. While this may sound like progress for some, a compounding cost of extreme wealth concentration is that it is highly inefficient resource utilization and bad for economic growth and human progress.

Case in point: the Organization for Economic Cooperation and Development, representing a number of the world’s richest countries including the United States, estimates that inequality has knocked nearly five percentage points off economic growth in those countries over the past 15 years, and the drag is getting worse with each passing year. See OECD: Why less inequality benefits all:

In high-inequality countries, people from poor households typically have less access to quality education. This leads to “large amounts of wasted potential and lower social mobility,” which directly harms economic growth, according to the OECD.

Whether one is in or out of the wealthiest percentile, pragmatists should admit that the largest factor driving income and wealth disparity over the past 20 years has not been merit or ‘hard work’ but rather extreme financialization which has ballooned asset bubbles and reinforced policies and incentives for corporations, central banks and governments to artificially boost the price of leveraged assets to unsustainable levels at the expense of labor and productivity. In the end, this trend is self-defeating for business, as well as everything else.

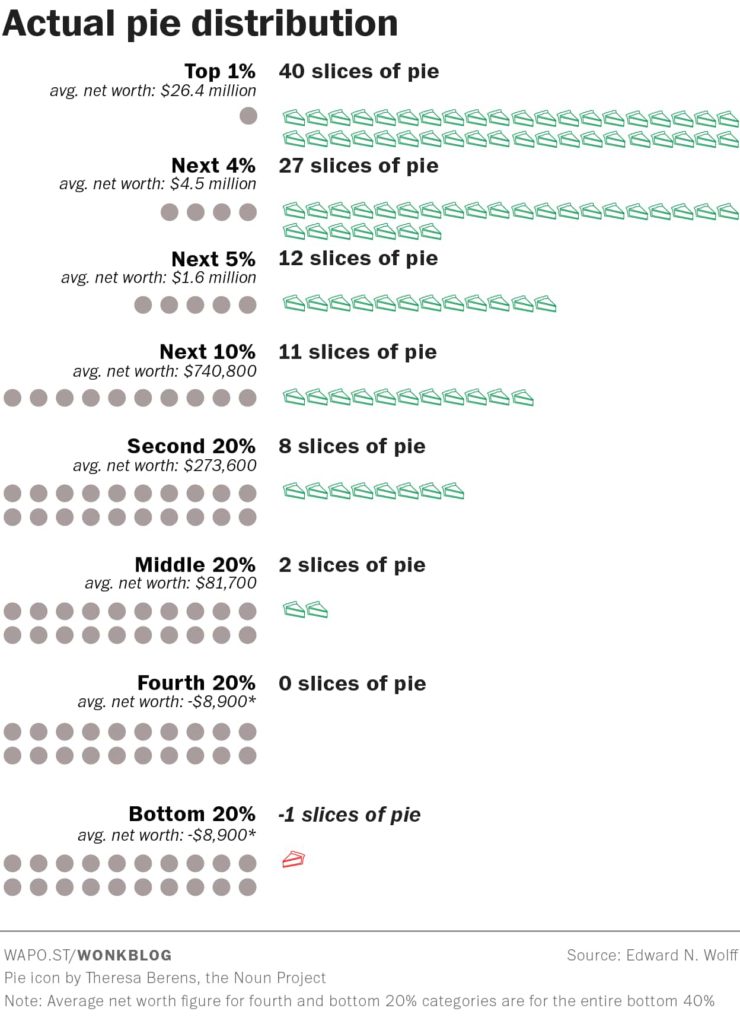

A good graphical explanation of the reality is captured in the below chart of pies. Where the top 1% of the population has 40 slices and the bottom 40% has no pie at all. The result: lots of wasted resources (pie) and a very low multiplier effect through the economy. See: The richest 1% of the population now owns more of the country’s wealth than at any time in the last 50 years.

Policies that continue to pile more pie where it is will go unused are just dumb management. And in the end history shows, folks with no pie eventually come and take pie off those that are hoarding it.

Policies that continue to pile more pie where it is will go unused are just dumb management. And in the end history shows, folks with no pie eventually come and take pie off those that are hoarding it.

A couple of easy rule changes that would go a long way to amend currently destructive incentives:

- re-ban corporate share buybacks (considered illegal market manipulation before 1982)

- Tie executive pay to balance sheet improvement rather than increases in share price

- Separate all investment underwriting and sales away from deposit-taking banks-backed by taxpayers.

- add a consumption based tax to the US