In the late 1800’s and early 1900’s the US government and court system found the political courage under the leadership of President Theodore Roosevelt to break up ‘bad trusts’ which were defined as companies that had become so big and controlling as to operate contrary to the public interest for consumer choice, free competition, the rule of law and maintaining corporate profits and executive compensation within a reasonable multiple of worker compensation. You can read more on this here.

It is very clear that we need to do this again. For an excellent modern day discussion and insightful charts on this topic see Jonathan Tepper’s Why American workers aren’t getting a raise: An American detective story. Here’s a taste:

Something has indeed gone very wrong with capitalism. In a competitive market, if a company is making a lot of money, other companies will get excited by the prospects of high profits and will enter the industry and compete. Eventually margins decline as more competitors fight each other. That is how dynamic, capitalist economies should be. Something is profoundly broken with capitalism if corporate profit margins do not

revert to the historical mean.

Rising industrial concentration is a powerful reason why profits don’t mean revert and a powerful explanation for the imbalance between corporations and workers. Workers in many industries have fewer choices of employer, and when industries are monopolists or oligopolists, they have significant market power versus their employees.

The role of high industrial concentration on inequality is now becoming clear from dozens recent academic studies. Work by The Economist found that over the fifteen-year period from 1997 to 2012 two-thirds of American industries were more concentrated in the hands of a few firms.[i] In 2015, Jonathan Baker and Steven Salop found that “market power contributes to the development and perpetuation of inequality.”.

..we have seen the number of listed firms fall by half, and many industries now have only a few big players. There is a strong and direct correlation between how few players there are in an industry and how high corporate profits are.

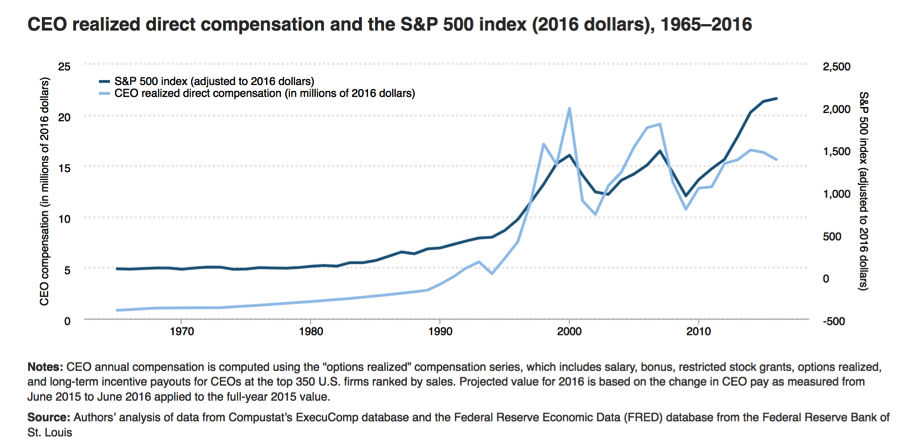

The below chart of CEO compensation effectively shows that the explosion in executive compensation since the late 1990’s has been fueled by the obsession with financialization that has levitated debt and share prices through non-productive share buybacks (which must be re-banned as market manipulation–because it is market manipulation).