On the weekend the Financial Post ran with an article headed Macquarie thinks housing will drag Canada into a recession as bad as the financial crisis in two years–and that’s the best case scenario. In it Macquarie Capital Markets correctly notes that Canada’s grotesquely inflated–now deflating–housing market is a recession catalyst in motion, with the share of Canadian employment tied to construction, finance, insurance and real estate sales nearly two standard deviations above its long-term average.

In the process, Macquarie, like us, sees the U.S. dollar likely to appreciate against the loonie over the next year or so and warns of capital risks in sectors with concentrated domestic exposure like banks, consumer and telecom services.

Like most other financial conglomerates however, Macquarie is an underwriting firm that helps corporations raise capital by selling securities to the public. The primary function of ‘investment advisory’ services offered therefore is to serve as a distribution channel ie., a constant pool of willing buyers for the corporate underwriting products.

This is the dominant business model in the industry and the main reason that financial ‘advisory’ services generally always recommend equity investments throughout every market cycle, even when, like now, their analysts are forecasting the likelihood of a severe recession. Go-to-risk-management in these models, is not to avoid exposure to overvalued equities and raise cash, but rather to ‘diversify’ or ‘rotate’ into other so-called ‘defensive’ equity sectors.

In this vein, while sounding the alarm about recession and late cycle risks, Macquarie and the majority of other firms recommend an ‘underweight’ in consumer sensitive sectors (ie., don’t sell the things that are going to lose a lot of value, just hold some lesser percentage of them than the broad market index) and an ‘overweight’ in energy, technology and industrials (ie., buy more of these sectors so that you hold a higher percentage than the broad market index). Sounds genius right?

Except, as shown in my partner Cory Venable’s chart here of the last bear market 2007-2009, there is no capital protection benefit in holding different types of equities heading into a bear market. When risk appetite recedes, all equity sectors including financials, dividend paying stocks, materials, gold and energy, all fall together (red line), with only the most liquid government bonds (grey line) and currencies like the US dollar, typically gaining on safety-seeking inflows.

Buy and holders beware, defensive to investment bankers and most advisors means assets that might lose 30 to 50% while others lose more.

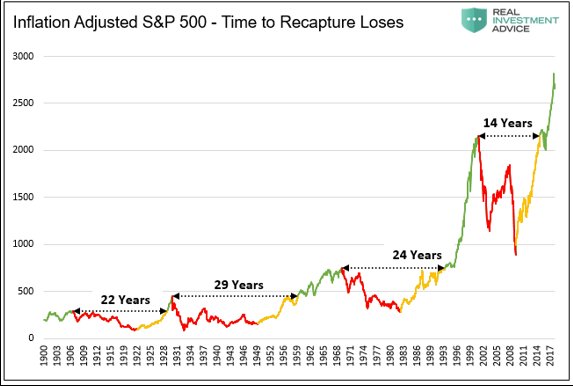

And once asset markets do mean revert at the end of secular over-valuation periods like 1906, 1929, 1968, 2000, and 2018 (as shown below), it typically takes more than 20 years to recover capital losses thereafter.

So we need to ask ourselves the question: Can we afford to spend 20+ years with zero net gains, just trying to make back our losses? How will that change our retirement plan withdrawals and lifestyle dreams? How will it impact our peace and happiness?

So we need to ask ourselves the question: Can we afford to spend 20+ years with zero net gains, just trying to make back our losses? How will that change our retirement plan withdrawals and lifestyle dreams? How will it impact our peace and happiness?

These are the practical questions we all need to consider when making asset allocation choices today. Great opportunities are no doubt coming to those who can buy low in the next bear market, but only for those who don’t decimate their capital in the downturn first.