Speculative capital allocations move with extreme credit cycles through boom and bust. But in the end, sustained price appreciation requires new buyers who are able to buy assets from existing owners. Both groups now share a common problem: too much debt.

We have been tracking the intersection of these trends for some time now and unsurprisingly, the inevitable is materializing.

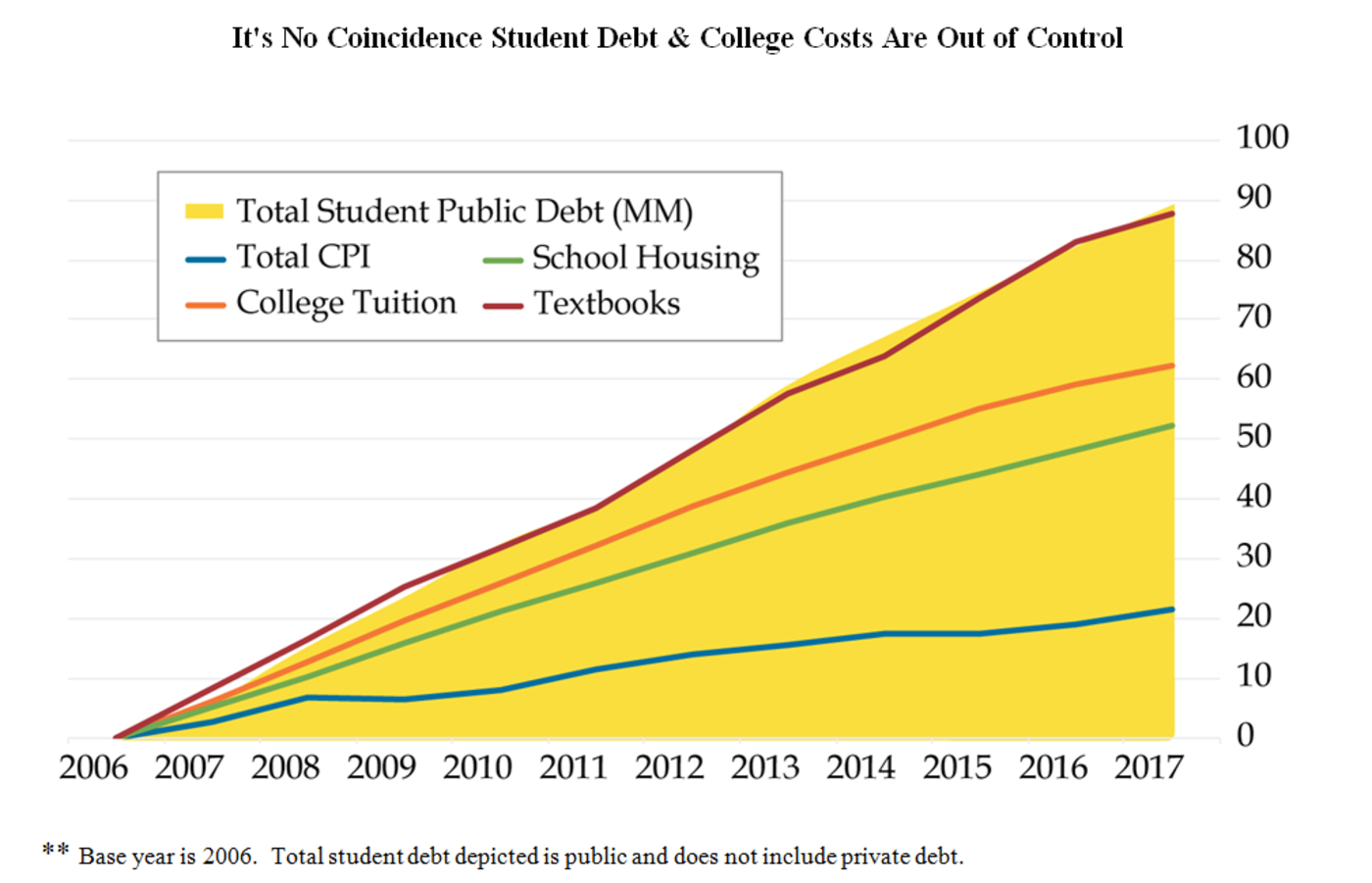

One nexus with particularly broad impacts: the easy credit that enabled home prices and rents to far outpace wage gains in recent years, is the same easy credit that enabled education costs (textbooks, tuition and student housing) to leap more than 3x the cost of inflation as charted below. In a word: unsustainable. Debt cannot grow to the sky, and so neither can asset and education prices.

School budgets have ballooned as students have become debt enslaved. Once debt can no longer be added, lower prices are necessary for assets and services.

School budgets have ballooned as students have become debt enslaved. Once debt can no longer be added, lower prices are necessary for assets and services.

The first will take a chunk out of the net worth of present holders, both will take a chunk out of corporate profits and balance sheets. Painful for financial markets and the leverage-soaked global economy in the near term, but all needed to reboot the system on a more rational, organic path for future growth. Hark the sound of inevitability, see Student loans are starting to bite the economy: potential homeowners are being thwarted by the costs of paying off bills for higher education.

From 2007 through 2017, the CPI rose by 21 percent. Over that same period, college tuition costs jumped 63 percent, school housing surged 51 percent and the price of textbooks by 88 percent. These troubling growth rates wipe away any mystery behind today’s staggering levels of student loan debt, which have almost tripled from the 2007 starting point of $545 billion. As of the fourth quarter, student loans represented 10.5 percent of a record $13.1 trillion in U.S. household debt, up from 3.3 percent at the start of 2003.